$40 Million in Withdrawals Signal Mixed Institutional Sentiment as Bitcoin Trades Near $107,800

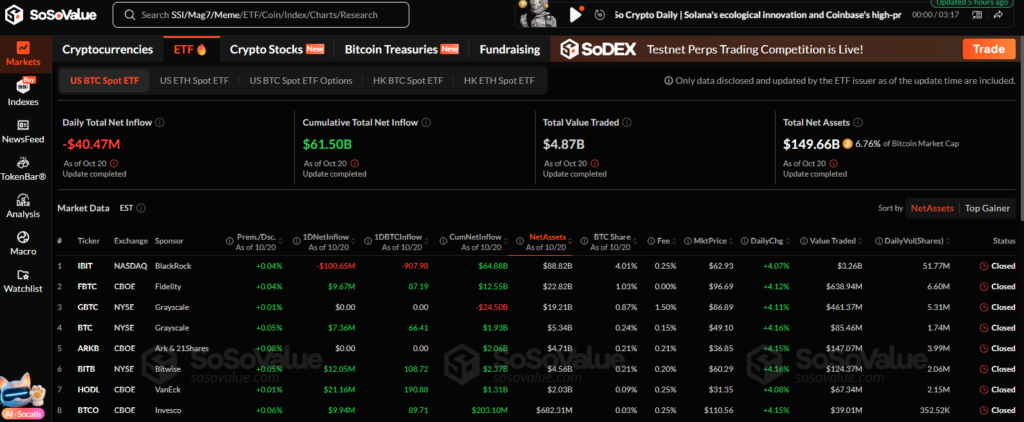

U.S. spot Bitcoin exchange-traded funds (ETFs) continued to record net outflows for the fourth consecutive day, with investors pulling $40.5 million on Monday, even as broader crypto markets attempted a modest recovery.

The outflows, according to recent fund data, underscore an ongoing institutional cool-off following weeks of volatility and macroeconomic uncertainty. BlackRock’s IBIT led the decline, posting $100.7 million in withdrawals, which were only partially balanced by smaller inflows into funds operated by Fidelity, Grayscale, Bitwise, VanEck, and Invesco.

ETF Flows Diverge from Market Price Action

Interestingly, the persistent ETF redemptions came as Bitcoin briefly rebounded above $111,000 before retreating nearly 3% to $107,871 early Tuesday. Analysts suggest this decoupling between ETF flows and price movement reflects a broader structural shift in crypto market dynamics.

“Prices were climbing even amid ETF outflows when spot and derivatives demand offset institutional redemptions, especially during risk-on shifts or when ETF flows lag underlying market appetite,” explained Vincent Liu, Chief Investment Officer at Kronos Research.

He added that the recent data “points less to a clean split between institutional and retail sentiment, and more to market structure in motion — with hedging flows, derivative rotations, and reporting lags all blurring the signal between actual demand and what ETF data shows.”

Macro Factors Weigh on Institutional Appetite

The downturn in ETF inflows follows renewed U.S.–China tariff tensions, heightened bond market volatility, and a stronger U.S. dollar, all of which have pressured risk assets, including cryptocurrencies. The ongoing Federal Reserve rate uncertainty has also contributed to a more cautious investment tone across digital asset markets.

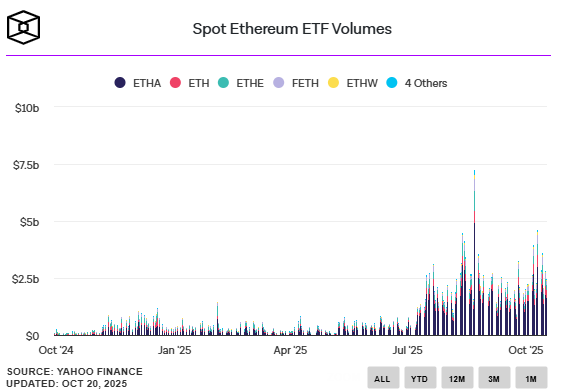

Meanwhile, spot Ethereum ETFs saw $145.7 million in net outflows, marking their third straight day of withdrawals — adding to the sentiment that institutional investors may be consolidating exposure after months of aggressive accumulation.

Market Outlook: Structural Realignment, Not Panic

Despite the outflows, analysts remain cautiously optimistic. “This doesn’t mark capitulation but rather a recalibration of positions,” one market strategist noted, emphasizing that ETF flows often lag real-time trading sentiment.

With Bitcoin holding above $107,000 support, and volatility moderating after last week’s sell-off, traders are watching closely to see whether inflows return once macro headwinds stabilize and risk appetite improves heading into November.

ETF outflows may not signal weakness — instead, they highlight a market adapting to new liquidity dynamics and short-term hedging behavior.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.