U.S. spot bitcoin exchange-traded funds (ETFs) experienced significant outflows on Monday, with nearly $395 million exiting the market. The decline follows a weekend sell-off sparked by escalating geopolitical concerns between the U.S. and the EU.

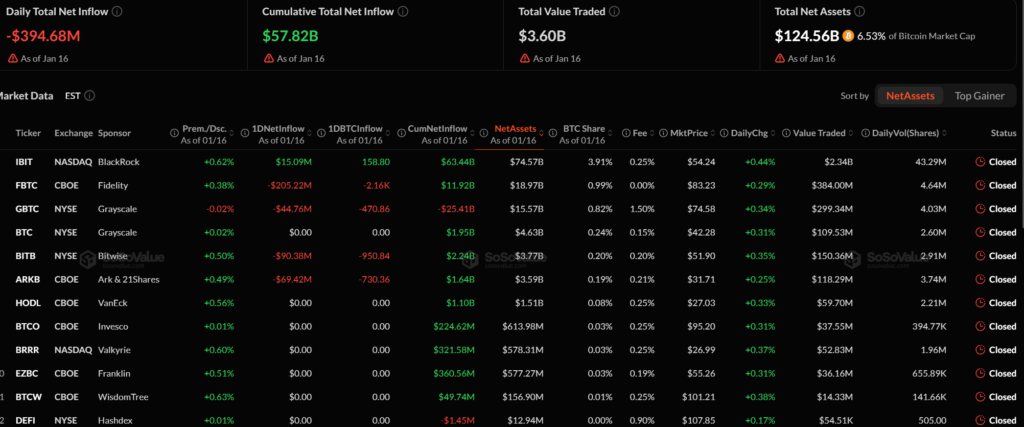

Data shows that Fidelity’s FBTC led the outflows, losing $205 million, while other major ETFs including Grayscale GBTC, Bitwise BITB, and Ark & 21Shares ARKB also recorded substantial withdrawals. In contrast, BlackRock’s IBIT saw modest inflows of $15 million. Monday’s activity ended a four-day inflow streak totaling over $1.8 billion, which had pushed bitcoin prices above $95,800 last week.

According to data from SoSoValue;

The market downturn coincides with U.S.-EU trade tensions, after U.S. leadership suggested potential tariff escalations over Greenland’s sale. EU officials have threatened retaliatory measures including service restrictions, new taxes, and investment limits. Bitcoin responded by sliding from $95,000 to around $90,979 at the time of reporting.

Other crypto ETFs showed mixed results: Ethereum ETFs gained $4.6 million, XRP funds saw $1.1 million inflows, while Solana ETFs experienced their first outflow since early December at $2.2 million. Analysts warn that ongoing macro and geopolitical uncertainty is likely to keep crypto markets volatile, with bitcoin potentially testing support levels between $67,000 and $74,000.

Investors remain cautious as trade tensions and postponed U.S. crypto regulations continue to influence digital asset flows and market sentiment. The current environment underscores the sensitivity of bitcoin ETFs to global political developments.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.