The U.S. spot bitcoin ETF market recorded another sharp reversal, with investors pulling nearly $545 million in a single day as bitcoin prices continued to slide and risk appetite weakened across global markets.

Bitcoin ETF Outflows Extend to Two Days

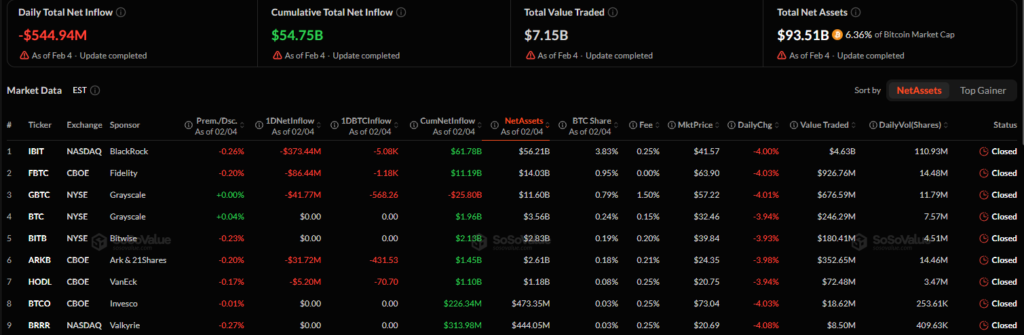

On Wednesday, U.S. spot bitcoin exchange-traded funds posted net outflows of approximately $544.94 million, extending the two-day withdrawal total to $816.96 million. The pullback followed a strong inflow earlier in the week, highlighting growing short-term uncertainty among institutional investors.

The largest share of redemptions came from BlackRock’s IBIT, which saw more than $373 million exit the fund. Fidelity’s FBTC and Grayscale’s GBTC also reported notable outflows of $86.44 million and $41.77 million, respectively. Additional selling pressure was observed across products from Ark & 21Shares, VanEck, and Franklin Templeton.

Bitcoin Price Decline Impacts Sentiment

The ETF outflows coincided with a broader downturn in the crypto market. Bitcoin briefly dropped below the $71,000 level, marking its lowest price since October 2024. The decline reflected a wider risk-off environment affecting global financial assets.

Long-Term ETF Inflows Remain Strong

Despite recent volatility, U.S. spot bitcoin ETFs continue to hold a significant position in the market. Since their launch, these funds have attracted $54.75 billion in net inflows, with total assets accounting for around 6.36% of bitcoin’s overall market capitalization.

Selling pressure extended beyond bitcoin products. U.S. spot Ethereum ETFs recorded nearly $79.5 million in net outflows, while spot Solana ETFs also posted losses. In contrast, spot XRP ETFs saw modest net inflows, signaling selective investor interest within the digital asset sector.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.