Faster Growth Highlights Rapid Maturation of the Crypto ETF Market

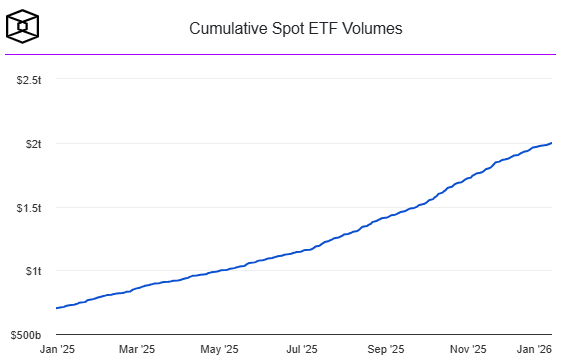

US-listed spot cryptocurrency exchange-traded funds reached a major milestone at the start of 2026, with cumulative trading volume surpassing $2 trillion. The pace of growth is accelerating, underscoring rising institutional adoption of regulated crypto investment products.

Trading Volume Doubles in Half the Time

Spot crypto ETFs crossed the $2 trillion cumulative volume mark on January 2, less than two years after their initial launch in January 2024. Notably, it took roughly 16 months to reach the first $1 trillion, but only eight additional months to double that figure, signaling a sharp increase in trading activity and liquidity.

Bitcoin and Ethereum ETFs Drive Market Share

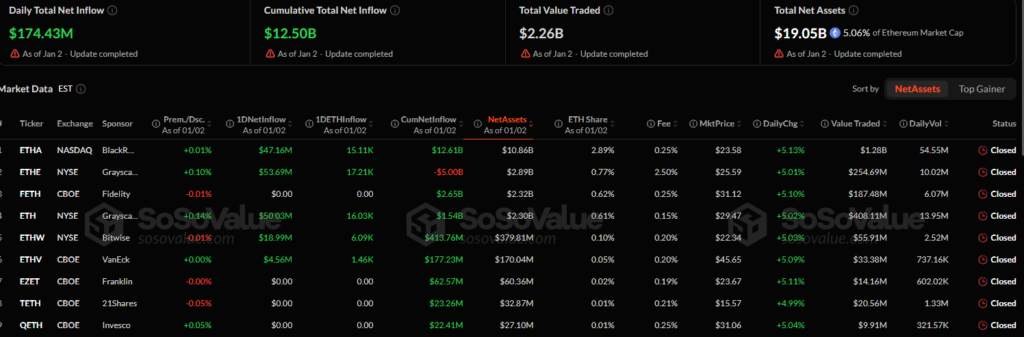

Bitcoin and Ethereum ETFs remain the backbone of the market. During 2025, Bitcoin ETFs recorded approximately $21.8 billion in net inflows, while Ethereum ETFs attracted around $9.8 billion. One Bitcoin ETF alone commands about 70% of total trading volume, highlighting strong concentration among leading issuers.

The trading volume surge also reflects a broader product lineup. New spot ETFs tracking assets such as Solana, XRP, Dogecoin, Litecoin, Hedera, and Chainlink entered the market after streamlined regulatory approvals. XRP-based ETFs have led the new cohort, drawing over $1.2 billion in net inflows since launch.

Spot Bitcoin and Ethereum ETFs opened 2026 with $645.6 million in combined net inflows on the first trading day, reversing late-2025 outflows and reinforcing expectations that institutional participation will continue to deepen throughout the year.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.