Stablecoins are a type of cryptocurrency designed to maintain a stable value by pegging to a reserve asset such as the U.S. dollar, euro, or gold.

Unlike volatile cryptocurrencies like Bitcoin and Ethereum, stablecoins offer price stability, making them ideal for everyday transactions, cross-border payments, and remittances.

The most popular stablecoins include USDT (Tether), USDC (USD Coin), and DAI, each backed by various assets to ensure consistent value.

The Economic Revolution: Stablecoins in Action

Stablecoins are transforming how the global economy operates. By enabling instant, borderless transactions without the need for traditional banks, stablecoins provide faster, cheaper, and more accessible financial services.

“Stablecoins are a bridge between fiat and crypto — a safe on-ramp for users entering Web3,” says Circle CEO Jeremy Allaire.

In regions with high inflation or limited banking infrastructure, stablecoins allow individuals to store value, receive salaries, and conduct commerce in a more secure and stable currency.

Institutional and Government Adoption on the Rise

Traditional financial institutions and governments are taking notice. Visa and Mastercard have begun supporting stablecoin payments, and several central banks are exploring Central Bank Digital Currencies (CBDCs) inspired by stablecoin architecture.

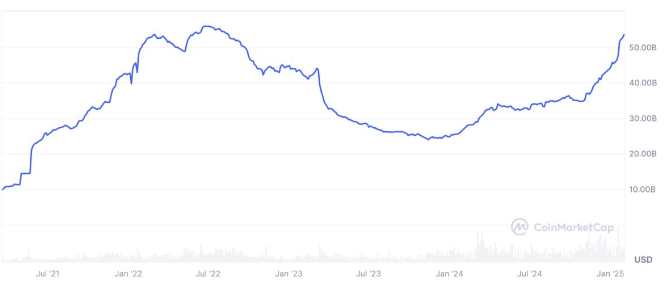

In 2024 alone, stablecoins facilitated over $10 trillion in transactions, a number that continues to grow rapidly.

Countries like Singapore, Switzerland, and the UAE have embraced stablecoin-friendly regulations, accelerating innovation while maintaining financial oversight.

Stablecoins vs. Traditional Finance

Compared to traditional banking systems, stablecoins offer 24/7 availability, near-instant settlement, and significantly lower fees.

“Stablecoins offer the benefits of blockchain without the risk of extreme volatility,” says a recent report from the Bank for International Settlements.

They also enhance transparency by operating on public blockchains, reducing fraud and improving auditability.

Challenges Ahead: Regulation and Trust

Despite their potential, stablecoins face challenges such as regulatory uncertainty, reserve transparency, and centralization concerns.

The collapse of TerraUSD in 2022 highlighted the risks of algorithmic stablecoins and the need for robust backing mechanisms.

To build public trust, regulators are now pushing for clear guidelines, regular audits, and full disclosure of reserves.

Conclusion

Stablecoins are more than just a digital dollar — they are reshaping the global financial landscape by combining the trust of fiat with the efficiency of blockchain.

As adoption grows, stablecoins could become the default medium for digital transactions across the world.