A recent survey of 4,658 crypto users across 15 countries, commissioned by BVNK and conducted by YouGov, found that 39% of respondents receive part of their income in stablecoins, while 27% use them for daily payments. The study highlights that lower fees and faster cross-border transfers are key drivers for adoption, especially in emerging markets.

Survey participants reported holding an average of $200 in stablecoins globally, rising to around $1,000 in high-income economies. Respondents using stablecoins for income stated that the assets make up roughly 35% of their annual earnings. Cross-border transfers using stablecoins offered about 40% in fee savings compared to traditional remittance methods.

Stablecoins Becoming Mainstream for Payments

More than half of crypto holders have made purchases specifically because merchants accepted stablecoins, increasing to 60% in emerging markets. Adoption is higher in middle- and lower-income economies, with Africa recording 79% ownership. Users typically manage stablecoins across multiple tokens and platforms, including exchanges, payment apps, and mobile wallets, rather than hardware wallets.

Enterprise and Payroll Integration

Stablecoins are increasingly integrated into regulated payroll systems under initiatives like the US GENIUS Act and Europe’s MiCA framework. Platforms such as Deel now allow employees to receive salary payouts in stablecoins, while enterprise adoption grows through acquisitions like Paystand’s purchase of Bitwage.

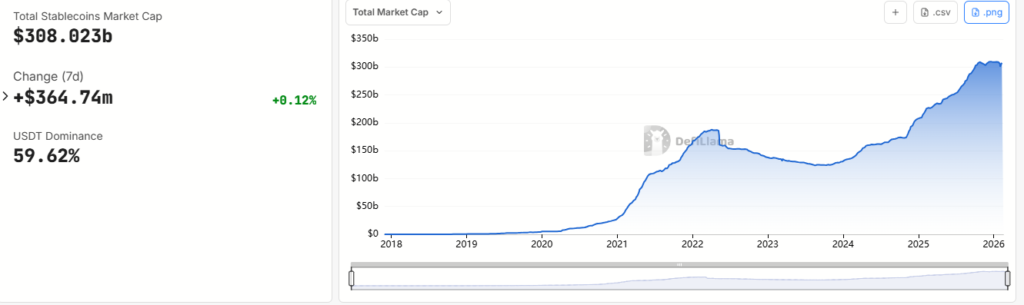

The stablecoin market has grown to $307.8 billion, up from $260.4 billion in mid-2025, reflecting increasing global usage for wages, payments, and cross-border settlements.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.