Standard Chartered’s venture arm, SC Ventures, is preparing to launch a $250 million cryptocurrency investment fund by 2026, signaling a fresh wave of institutional interest in the digital asset space. Backed by Middle Eastern investors, the fund aims to capture global opportunities in blockchain and digital finance.

According to Bloomberg, SC Ventures plans to raise $250 million in capital to deploy into a wide range of digital asset-focused opportunities. The fund will specifically target investments across the financial services sector, aligning with the growing demand for blockchain-powered solutions.

Operating partner Gautam Jain revealed that the initiative is scheduled to launch in 2026, with Middle Eastern investors acting as the primary backers. The move reinforces the region’s growing role in global crypto adoption, as Gulf nations continue to emerge as significant players in the Web3 economy.

Institutional Appetite for Digital Assets Grows

The upcoming SC Ventures fund comes amid a trend of corporate treasuries and institutional investors increasing their exposure to cryptocurrencies. In recent years, large firms have pursued accumulation strategies, further validating digital assets as a long-term investment class.

Standard Chartered’s decision also highlights confidence that institutional inflows will rise in the coming years, particularly as infrastructure, regulation, and market maturity improve.

Additional Funds Beyond Crypto

SC Ventures is not stopping at digital assets. The firm also plans to launch a $100 million Africa-focused investment fund, aimed at fueling regional growth and innovation. Additionally, the venture arm is considering its first-ever venture debt fund, which could diversify its global financing strategy.

While these additional funds may not directly involve cryptocurrencies, their creation shows the bank’s broader ambition to expand its presence in emerging markets and innovative sectors.

Market Concerns Over Digital Asset Treasuries

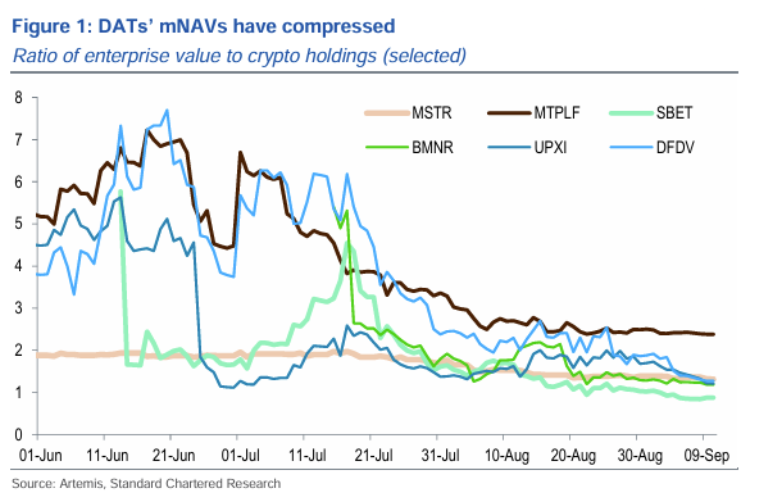

The announcement comes shortly after Standard Chartered raised caution about digital asset treasury (DAT) firms. The bank highlighted that many such firms have seen their market net asset value (mNAV) fall below the critical 1.0 threshold, a level that suggests challenges in raising capital through share issuance.

Despite these risks, Standard Chartered emphasized that larger, more efficient firms with access to low-cost funding and staking yields remain in a strong position. This indicates that institutional strategies may increasingly favor top-tier players while weaker firms face consolidation.

A Broader Shift in Institutional Crypto Adoption

Standard Chartered’s $250 million crypto fund is part of a larger wave of institutional engagement with digital assets beyond Bitcoin. For instance, Nasdaq-listed Helius Medical Technologies recently unveiled a $500 million treasury reserve strategy, with Solana (SOL) serving as its primary reserve asset.

Such moves highlight a diversification trend where institutions are not only considering Bitcoin but also exploring leading altcoins and blockchain platforms.

The launch of SC Ventures’ $250 million crypto fund in 2026 marks another step toward mainstream adoption of digital assets. With backing from Middle Eastern investors and a focus on global opportunities, the initiative underscores the increasing role of institutions in shaping the future of the crypto ecosystem.

As more corporate treasuries and venture funds expand into digital assets, the sector may see accelerated growth, stronger infrastructure, and broader recognition as a core component of global finance.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.