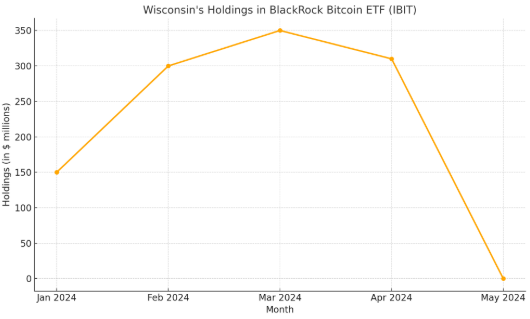

In a significant move that has caught the attention of financial markets, the State of Wisconsin Investment Board (SWIB) has offloaded more than $300 million worth of shares in BlackRock’s iShares Bitcoin Trust ETF (IBIT). The sale comes just months after the state’s pension fund made headlines for becoming one of the first institutional investors to take a large position in a spot Bitcoin ETF following its approval in January 2024.

Institutional Exit Raises Eyebrows in Crypto Circles

The sell-off was disclosed through recent 13F filings with the U.S. Securities and Exchange Commission (SEC), showing that Wisconsin significantly reduced its exposure to IBIT, sparking speculation about shifting investment strategies or concerns about Bitcoin’s near-term price trajectory.

The $300 million divestment is notable given the broader narrative of growing institutional adoption of Bitcoin through regulated financial products like ETFs. SWIB’s original investment in IBIT was widely seen as a vote of confidence in the long-term viability of Bitcoin as an asset class.

While no official statement was issued by SWIB regarding the rationale behind the sale, analysts suggest that the move could be tied to portfolio rebalancing, risk mitigation, or profit-taking following recent BTC price volatility.

Bitcoin ETF Flows Reflect Broader Market Sentiment

The BlackRock iShares Bitcoin ETF has been among the most successful Bitcoin ETFs since their historic approval earlier this year. At its peak, IBIT attracted billions in inflows, cementing BlackRock’s dominant position in the emerging spot Bitcoin ETF space.

However, the market has experienced choppy waters in recent weeks, with Bitcoin prices fluctuating between $58,000 and $64,000. Some institutional investors may be choosing to lock in profits or rotate capital into less volatile assets, especially as traditional markets remain uncertain due to rising interest rates and global macroeconomic tensions.

What This Means for Institutional Crypto Adoption

The Wisconsin move doesn’t necessarily indicate a reversal in the institutional trend toward Bitcoin. Instead, it highlights the fluid nature of institutional strategies, which can include entering and exiting positions based on short- to medium-term performance metrics rather than ideological commitment to digital assets.

Some experts view the move as part of standard asset management practice, particularly for public pension funds tasked with ensuring steady, long-term returns.

Conclusion

The State of Wisconsin’s $300 million exit from BlackRock’s Bitcoin ETF is a reminder that institutional crypto adoption is not immune to the same market forces that drive traditional finance. While the sale may raise short-term concerns among Bitcoin enthusiasts, it also reflects the maturation of the crypto market — one where profit-taking and strategic shifts are part of a more sophisticated investment ecosystem.