XLM Price Holds Steady Near $0.321 Following Sharp Volume Spike

Stellar’s XLM token rose 2.5% in the last 24 hours, extending its short-term rebound while maintaining stability near $0.321. The move followed a breakout above key resistance levels, supported by a 350% surge in trading volume, suggesting heightened interest from larger market participants.

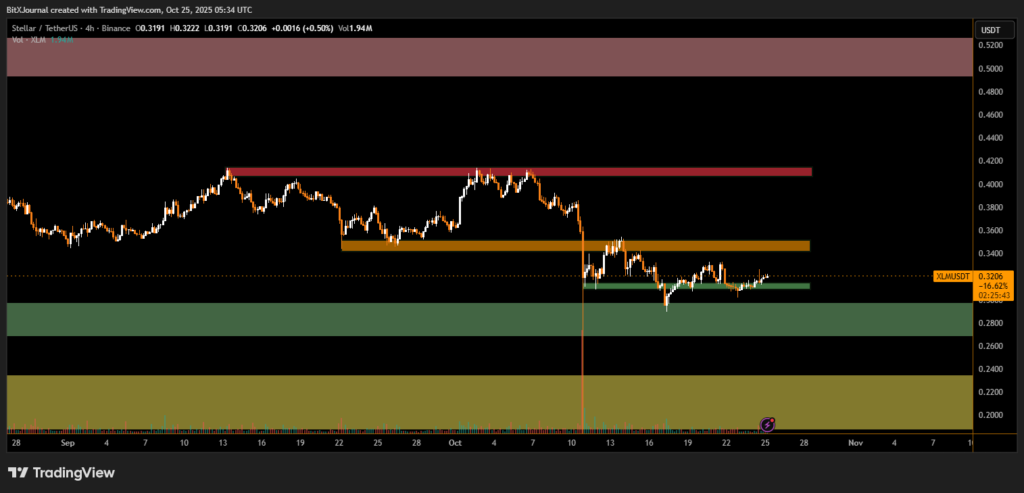

The price action marks an important development for Stellar, as the token continues to consolidate within an emerging bullish structure. On the 4-hour timeframe, XLM is currently retesting the immediate support zone between $0.312 and $0.316, a region that previously acted as resistance earlier in the week.

Technical Structure Points to Healthy Accumulation Phase

Market data indicates that Stellar’s uptrend remains intact, despite minor profit-taking following the breakout. The next major resistance lies near the $0.345–$0.350 zone, while a more significant supply barrier can be seen between $0.405 and $0.420, where sellers have historically regained control.

“The recent breakout on surging volume is not retail-driven,” noted BITX crypto market analyst. “This kind of activity often signals institutional accumulation, especially when followed by low-volatility consolidation rather than immediate rejection.”

Such patterns often precede broader bullish continuations, provided the asset sustains support and maintains healthy liquidity.

The increase in on-chain activity and growing adoption of Stellar’s payment infrastructure have strengthened long-term investor confidence. Analysts point out that XLM’s steady performance amid broader market volatility could signal growing institutional trust in its fundamentals.

If buyers hold the $0.312–$0.316 range, XLM may aim for a retest of the $0.345 area in the short term. However, a decisive break below this zone could open the path toward the $0.290 demand region, marked in green on the chart — a level viewed as strong support by traders.

For now, Stellar’s consolidation phase appears to be a controlled pause within a broader accumulation cycle, hinting at renewed upside once momentum rebuilds.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.