Michael Saylor’s Strategy continues aggressive accumulation amid market volatility

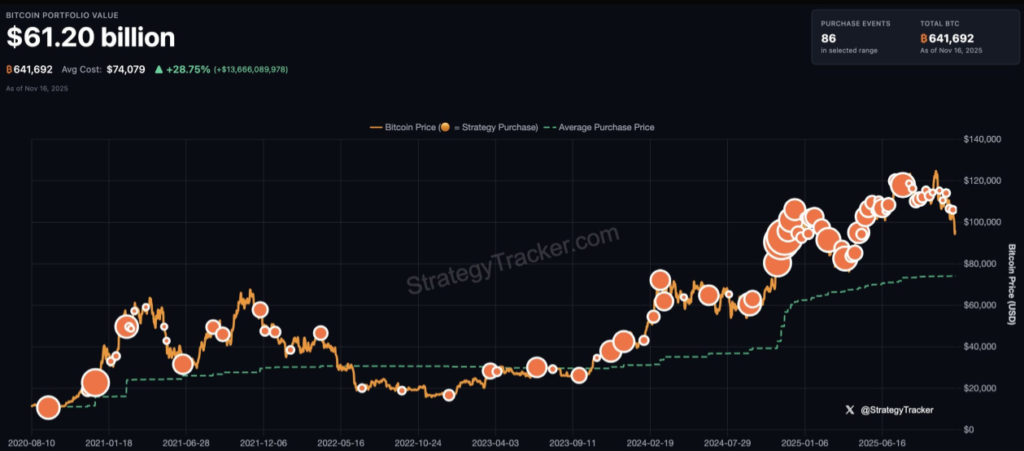

Bitcoin treasury company Strategy (formerly MicroStrategy) has acquired an additional 8,178 BTC for roughly $836 million, bringing its total holdings to 649,870 BTC. The purchases were made between November 10 and 16 at an average price of $102,171 per bitcoin, funded largely through proceeds from the company’s perpetual preferred stock offerings.

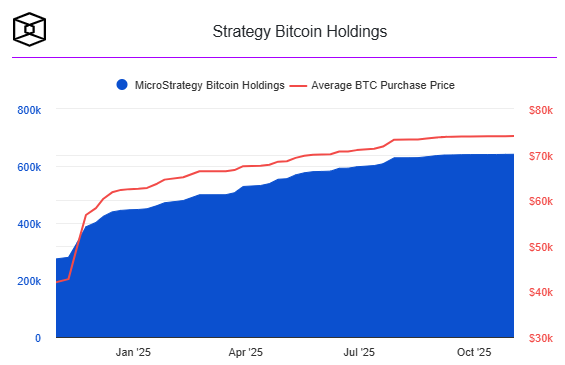

According to Michael Saylor, Strategy’s co-founder and executive chairman, the company’s total bitcoin holdings are now worth approximately $61.7 billion, bought at an average cost of $74,433 per BTC, representing $13.3 billion in unrealized gains at current market prices. These holdings account for over 3% of Bitcoin’s total supply.

The latest purchases mark the largest acquisition since July and were financed via multiple preferred stock programs, including STRK, STRF, STRC, and STRE, as well as a €620 million issuance of euro-denominated preferred stock. These instruments vary in convertibility and dividend structure, providing Strategy with flexible funding options for bitcoin accumulation.

Saylor highlighted the significance of the week’s buys, calling it a “₿ig week” on the company’s bitcoin acquisition tracker. Analysts at Bernstein emphasized that despite recent declines in Strategy’s stock value, the firm is not selling any bitcoin and continues to maintain conservative leverage, with $8 billion in debt against $61 billion in bitcoin holdings. They noted that the company’s capital structure allows it to weather significant market downturns while continuing its acquisition program.

The broader corporate trend shows 194 public companies adopting bitcoin treasury strategies, with notable holders including MARA, Coinbase, and Riot Platforms. However, many bitcoin treasury company stocks are down significantly from summer peaks due to compressions in market cap-to-net asset value ratios.

Saylor remains confident in Strategy’s long-term approach, emphasizing that the company’s mix of equity, convertible debt, and preferred instruments can sustain it through prolonged bitcoin market corrections. Recent rumors of a 47,000 BTC sale were categorically denied, with Saylor affirming the firm is buying aggressively, not selling.

With this latest acquisition, Strategy demonstrates its continued commitment to bitcoin accumulation, reinforcing its position as a leading corporate holder and signaling strong confidence in the cryptocurrency’s long-term value.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.