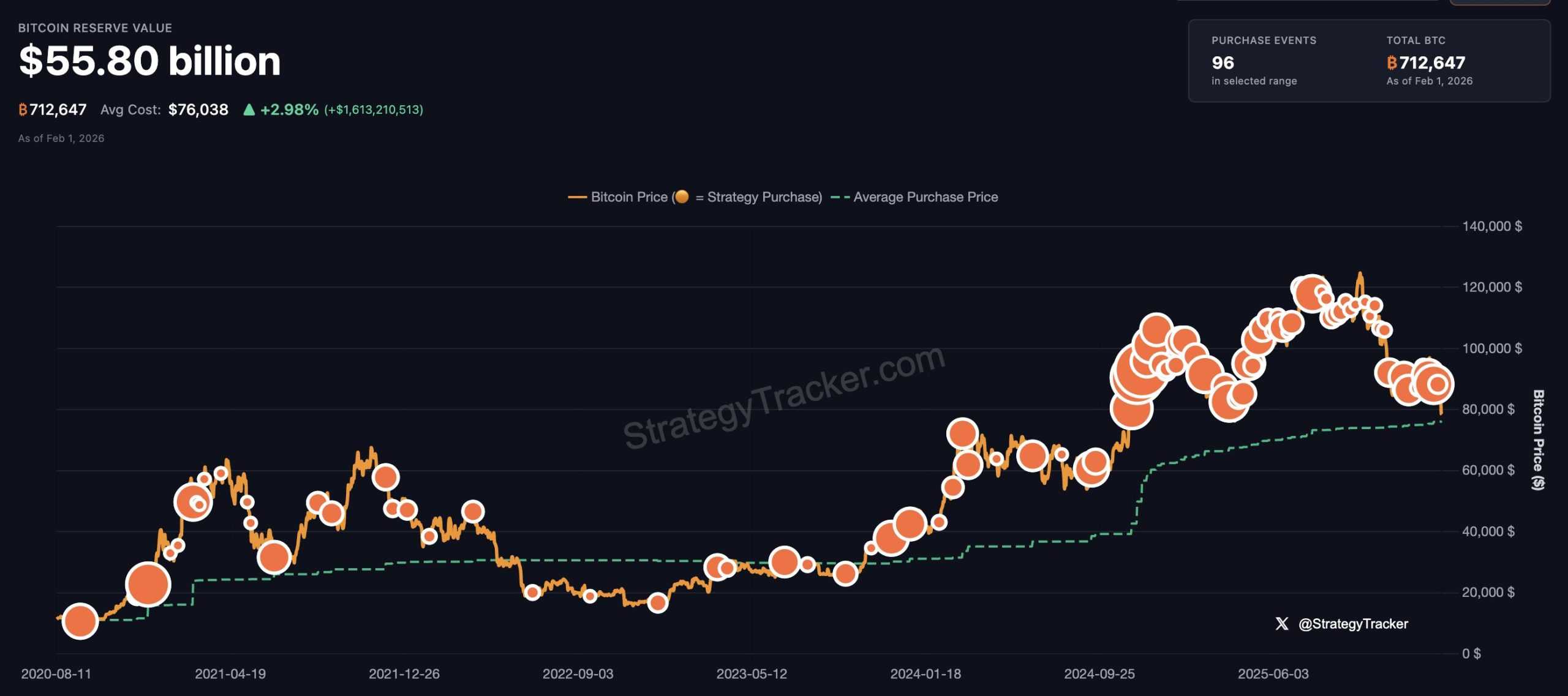

Strategy has added to its already massive Bitcoin position, acquiring another 855 BTC for approximately $75.3 million as prices continued to slide. The purchase was made at an average price of $87,974 per Bitcoin during the period from Jan. 26 to Feb. 1, according to regulatory filings.

Total Bitcoin Holdings Exceed 713,000 BTC

Following the latest acquisition, Strategy now holds 713,502 Bitcoin, making it one of the largest corporate holders globally. The company’s total investment in Bitcoin stands at roughly $54.3 billion, with an average acquisition price of $76,052 per BTC. At current market prices, the holdings are valued near $56 billion, leaving only a narrow margin of unrealized gains.

During Monday’s market decline, Bitcoin briefly fell below Strategy’s average purchase price, pushing the firm’s holdings into an unrealized loss for the first time since late 2023.

The acquisition was funded through at-the-market sales of Strategy’s Class A common stock. Over the past week, the company sold more than 670,000 shares, generating over $100 million in proceeds. Billions of dollars in authorized share sales remain available under the program, providing continued funding capacity.

Strategy’s Bitcoin holdings represent more than 3% of Bitcoin’s total supply. However, declining crypto prices have weighed heavily on valuations across companies with Bitcoin-focused balance sheets, as investor sentiment remains cautious amid broader market volatility.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.