The largest public Bitcoin holder resumes accumulation, lifting total reserves to more than 672,000 BTC.

Strategy has returned to active Bitcoin accumulation, adding to its position after rebuilding cash reserves in recent weeks. The latest purchase reinforces the company’s long-term commitment to Bitcoin as a core treasury asset despite ongoing market volatility.

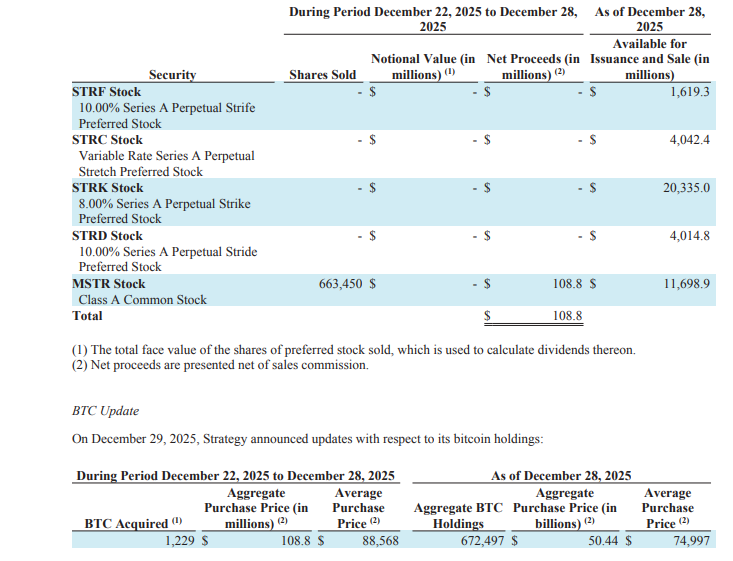

Strategy Bitcoin Acquisition Details

The company acquired 1,229 Bitcoin for approximately $108.8 million, paying an average price of $88,568 per BTC. This transaction increased Strategy’s total holdings to 672,497 Bitcoin, making it the largest publicly traded corporate holder of the asset.

In aggregate, Strategy has spent roughly $50.44 billion to build its Bitcoin position, with an average acquisition cost of $74,997 per coin. The purchase was financed through the sale of $108.8 million in Class A common stock, continuing the firm’s established strategy of capital markets funding.

Following the announcement, Strategy’s shares edged lower by about 1% in premarket trading, reflecting near-term sensitivity to Bitcoin price movements. At the same time, Bitcoin traded near $87,000, slightly below the company’s most recent purchase price.

By resuming accumulation after strengthening its dollar reserves, Strategy is signaling ongoing conviction in Bitcoin’s role as a long-duration store of value, positioning itself for potential upside as market conditions evolve.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.