Strategy has reinforced its position as the world’s largest corporate Bitcoin holder after completing its biggest Bitcoin purchase in more than a year, adding over 22,000 BTC to its balance sheet. The move underscores the company’s long-term conviction in Bitcoin despite ongoing market volatility and equity dilution concerns.

Between early and mid-January, Strategy acquired 22,305 Bitcoin for approximately $2.13 billion, paying an average price of $95,284 per BTC. This brings the firm’s total holdings to 709,715 BTC, now valued at roughly $64.5 billion at current market prices.

According to the company’s co-founder and executive chairman, Michael Saylor;

The company’s cumulative Bitcoin position was built at an average cost of $75,979 per BTC, translating into more than $10 billion in unrealized gains. Notably, Strategy now controls over 3.3% of Bitcoin’s maximum 21 million supply, a level of concentration unmatched by any other public company.

The latest purchases were financed through at-the-market sales of common shares and multiple classes of perpetual preferred stock. Strategy continues to rely on a diversified capital structure designed to support aggressive accumulation while managing long-term risk. The firm still has tens of billions of dollars in remaining issuance capacity, signaling further Bitcoin purchases may follow.

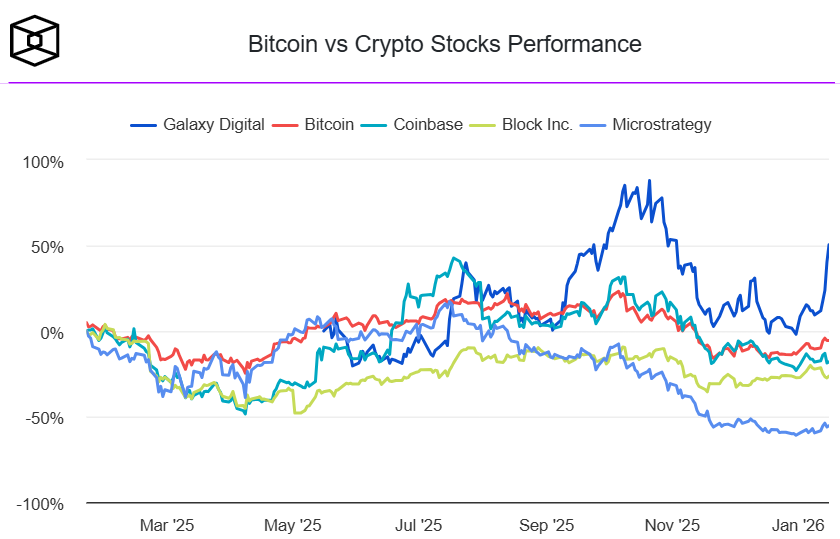

Despite the expanding Bitcoin treasury, Strategy’s market valuation has fallen below the value of its BTC holdings, with its market cap-to-net asset value ratio sitting near 0.85. Analysts warn that continued equity issuance could dilute Bitcoin yield per share, even as total holdings grow.

Still, the latest acquisition highlights Strategy’s unwavering approach: accumulate Bitcoin at scale and hold through cycles, regardless of short-term market sentiment.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.