Latest acquisition signals continued commitment to large-scale bitcoin accumulation despite market uncertainty

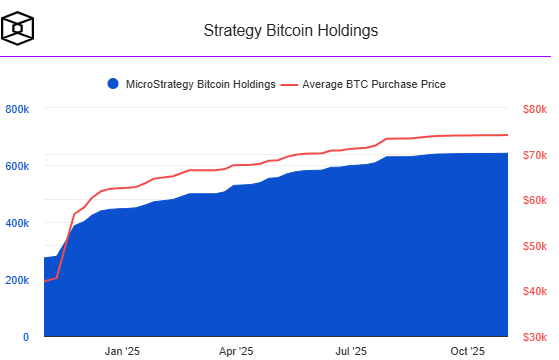

Strategy, the bitcoin-focused treasury company led by Michael Saylor, has executed one of its largest purchases of the year, adding 10,624 BTC between Dec. 1 and Dec. 7. The acquisition, valued at $962.7 million, pushes the firms total holdings to 660,624 BTC, reinforcing its position as the world’s largest corporate bitcoin owner.

Strategy Accelerates Accumulation Through Equity Sales

The latest purchase was funded through proceeds from at-the-market sales of the company’s Class A common stock and its STRD perpetual preferred shares. Last week Strategy raised $928.1 million through the sale of more than five million MSTR shares, while an additional $34.9 million came from STRD issuances. The firm still has over $17 billion in remaining authorization across its preferred stock ATM programs.

Strategy’s total bitcoin position acquired at an average price of $74,696 per BTC—is now worth roughly $60 billion, reflecting more than $10.6 billion in unrealized gains. The holdings represent over 3% of bitcoin’s fixed supply, underscoring the company’s aggressive, long-term accumulation model.

The firm recently established a $1.44 billion USD Reserve to support dividend payments on preferred shares and service its existing debt, a move analysts say positions Strategy to withstand extended market drawdowns. While some observers see the reserve as preparation for a potential bear market, others highlight the company’s resilience, noting that its first major debt maturity does not arrive until 2027.

Strategy’s latest purchase signals continued confidence in bitcoin’s long-term trajectory—even as market pressures and macro uncertainties reshape expectations across the industry.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.