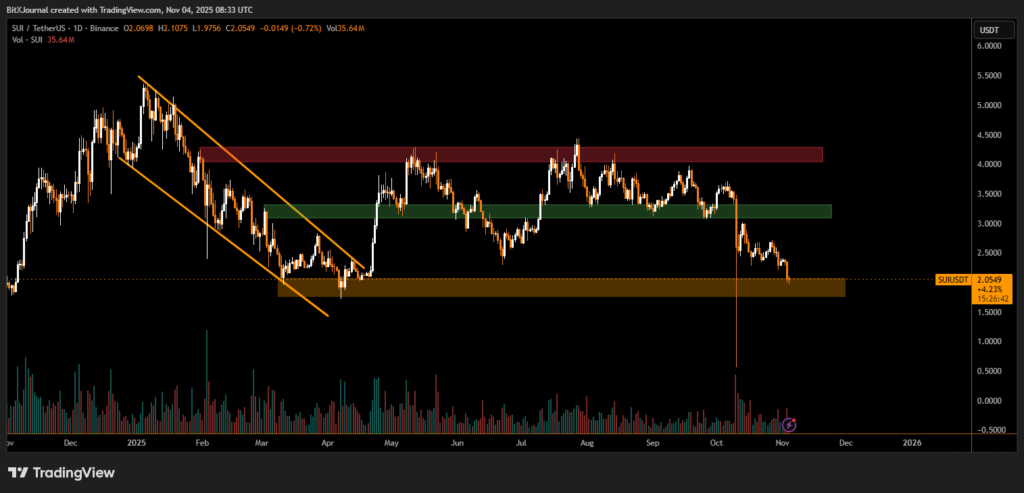

Institutional Pressure Forces Break Below Major Support; Weak Rebound Signals Caution

The SUI token faced a sharp pullback this week, tumbling more than 10% as heightened selling pressure from large investors pushed the asset below a long-standing support zone. While broader digital assets showed relative stability, SUI’s decline stood out, accompanied by a dramatic spike in volume that highlighted aggressive distribution.

The move unfolded after price action cracked through a key accumulation block near $2.10, triggering stops and accelerating downside momentum. Trading volume surged more than six-fold, coinciding with what analysts described as institutional exit behavior rather than routine retail volatility. Though SUI managed a brief intraday bounce off the lower liquidity zone around $1.95 to $2.00, the recovery lacked follow-through.

“When you see volume jump this disproportionately on a downside break, it usually reflects large hands rotating out, not panic retail selling,” said one BitXJournal digital-asset strategist. “Buyers stepped in off structural support, but it wasn’t aggressive enough to shift control.”

On the daily chart, the token remains pinned beneath a prior supply region and below the mid-range resistance around $2.60. The recent breakdown came after months of range-bound trading and follows a clean trend-channel breakdown earlier this year.

The most significant development is not the percentage drop, but the context around it.

Volume confirmed the trend change, suggesting the selling was deliberate, not reactive. This adds weight to the idea that short-term rallies may meet strong overhead resistance unless new capital returns.

“The bounce looks technical, not fundamental,” noted BitXJournal market researcher. “We need sustained bid strength and a reclaim of the $2.30–$2.40 zone before momentum meaningfully shifts.”

Until proven otherwise, market structure favors sellers, and short-term participants appear cautious, waiting for clearer confirmation of strength before engaging aggressively.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.