Swedish health tech firm H100 AB surged 37% in stock price after it announced its first-ever Bitcoin purchase on May 22, 2025. The company revealed that it acquired 4.39 BTC for 5 million NOK (approx. $490,000) at an average price of around $111,785 per Bitcoin.

This marks a historic move in Sweden’s health sector, as H100 becomes one of the first medical-focused firms in the region to adopt Bitcoin as part of its corporate treasury strategy.

“This move is part of our long-term financial strategy to diversify holdings and hedge against currency devaluation,” H100 said in a press release.

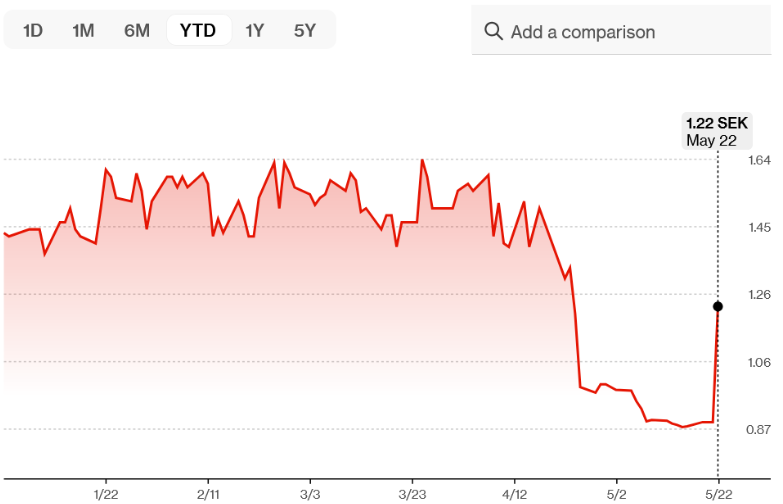

H100’s change in share price so far in 2025

Market Responds With Enthusiasm

Following the announcement, H100’s stock jumped by 37% in a single trading day, reflecting investor excitement over the firm’s forward-thinking approach. Analysts suggest this is part of a broader trend of institutional Bitcoin adoption that signals growing mainstream confidence in crypto assets.

H100’s share rally mirrors the historic impact of Bitcoin buys by Tesla and MicroStrategy, indicating that investor sentiment remains positive for companies bold enough to integrate digital assets.

China’s Jiuzi Holdings Plans 1,000 Bitcoin Purchase

EV Retailer Eyes Crypto Diversification

On the same day, Chinese electric vehicle seller Jiuzi Holdings revealed plans to buy 1,000 Bitcoin over the next 12 months, which equates to an investment exceeding $110 million at current market prices.

The Hangzhou-based company stated this is part of a strategic move to diversify its corporate assets and safeguard against fiat volatility while capitalizing on Bitcoin’s growing value proposition as “digital gold.”

“We believe Bitcoin is a long-term store of value and aligns with our global investment outlook,” Jiuzi’s board mentioned in a filing.

Corporate Crypto Adoption Grows Globally

Both announcements—by Sweden’s H100 and China’s Jiuzi—signal an accelerating global trend of corporate Bitcoin adoption.

From health tech to electric vehicles, companies across sectors are adding BTC to balance sheets to manage economic uncertainty and currency risk.

More corporations are expected to follow, especially as regulations become clearer and Bitcoin continues to outperform traditional assets over the long term.

Bitcoin’s Corporate Era Is Here

The 37% rally in H100’s stock and Jiuzi’s $110M Bitcoin roadmap reflect a seismic shift in how businesses view digital assets. With institutional confidence building and investor sentiment surging, Bitcoin is no longer just a speculative asset—it’s becoming corporate currency.

Expect more headlines like these as crypto becomes a cornerstone of modern finance.