A Major Shift in Global Banking Infrastructure

SWIFT, the global interbank messaging network that processes about $150 trillion in annual transactions, is officially moving into blockchain payments. Consensys founder Joe Lubin confirmed that SWIFT’s new real-time crypto settlement system will be built on Linea, an Ethereum Layer 2 network leveraging zk-rollup technology.

Why Linea Was Chosen

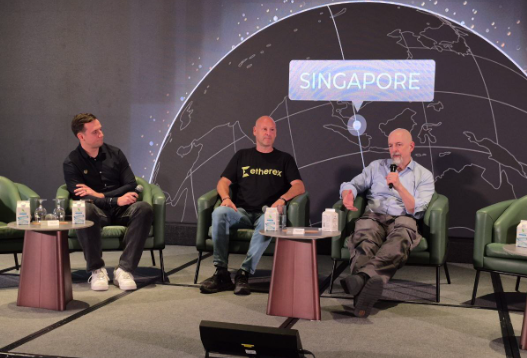

During the Token2049 conference in Singapore, Lubin revealed that SWIFT had already partnered with Consensys and over 30 traditional finance institutions to test the new system. Although the initial announcement avoided naming the blockchain, Linea’s selection was later confirmed.

Lubin explained the decision: “It’s about time to bring the two streams, DeFi and TradFi, together.”

Developed by Consensys, Linea enables faster and cheaper transactions, handling around 1.5 transactions per second at nearly one-fifteenth of Ethereum’s base cost. The network currently secures more than $2.2 billion in total value locked, ranking as the fourth-largest Ethereum Layer 2.

Major Banks Join SWIFT’s Blockchain Pilot

Some of the world’s most influential banks, including Bank of America, JPMorgan Chase, Citi, and Toronto-Dominion Bank, will participate in the trial phase. This marks a significant step toward mainstream adoption of blockchain in banking, as institutions seek 24/7 settlement with lower costs, fewer errors, and faster execution compared to existing rails.

Analysts suggest this move could put SWIFT in direct competition with Ripple’s XRP Ledger, one of the few blockchain-based systems already designed for cross-border banking payments.

Lubin also highlighted Linea’s potential beyond financial services, describing it as a foundation for “user-generated civilization.” According to him, Linea allows communities to create rules, infrastructure, and applications from the bottom up, in contrast to the centralized structures of governments and banks.

This development illustrates how blockchain is steadily reshaping traditional finance. If SWIFT’s pilot succeeds, a vast share of global payments could soon flow through decentralized infrastructure, bridging traditional finance and decentralized finance in a way that was once only theoretical.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.