Tether is positioning itself as a major player in the gold market, with plans to actively trade its reserves and expand its role in a potential post-dollar global economy, according to CEO Paolo Ardoino.

Tether’s Massive Gold Holdings

The stablecoin giant currently holds around 140 tons of gold, valued at approximately $23.3 billion, stored in a Cold War-era nuclear bunker in Switzerland. Ardoino highlighted gold as “logically a safer asset than any national currency”, emphasizing Tether’s strategy to reinvest earnings into precious metals. The company has been purchasing one to two tons of gold per week and plans to maintain this pace in the coming months.

Expanding into Gold Trading

Beyond holding reserves, Tether intends to enter the gold trading arena, targeting large banking institutions like JPMorgan and HSBC. The company has hired senior HSBC gold traders to develop strategies for actively trading gold and capturing arbitrage opportunities.

Tether has also diversified its portfolio by acquiring stakes in Canadian-listed firms such as Elemental Altus Royalties and Gold Royalty Corp, leveraging the strong rally in precious metals.

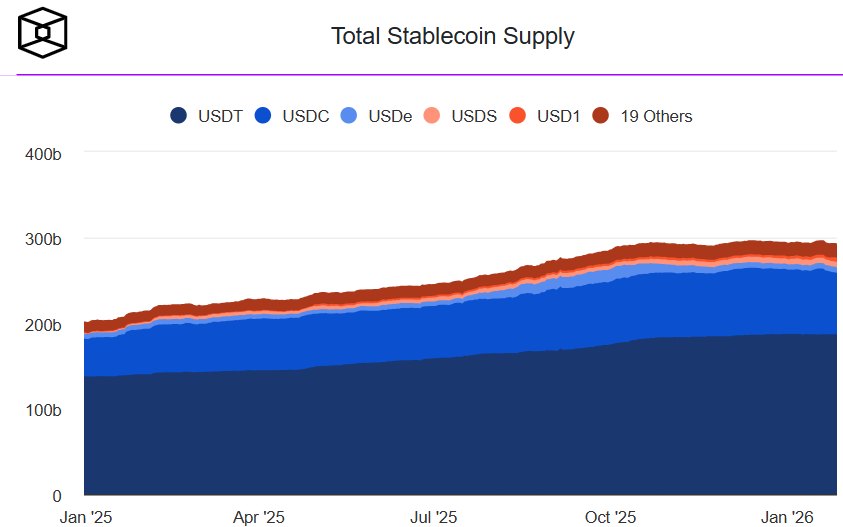

Tether’s flagship product, USDT, dominates the stablecoin market with over $186 billion in circulation, providing capital to back strategic investments in gold. Additionally, Tether Gold (XAUT) controls more than 50% of the gold-backed stablecoin market, valued at $2.62 billion.

Ardoino envisions Tether becoming one of the world’s largest “gold central banks,” capturing opportunities in bullion markets while reinforcing its stablecoin-backed financial ecosystem.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.