Tether has officially launched its USAT stablecoin, marking a significant step into the U.S. regulated market. Designed as a U.S. dollar-backed digital asset, USAT aims to operate fully within the federal regulatory framework providing American users with a secure and compliant stablecoin option. This launch follows the passage of the GENIUS Act, a legislative measure that formalizes the regulatory landscape for stablecoins in the United States.

USAT Brings Federally Regulated Dollar-Backed Stability

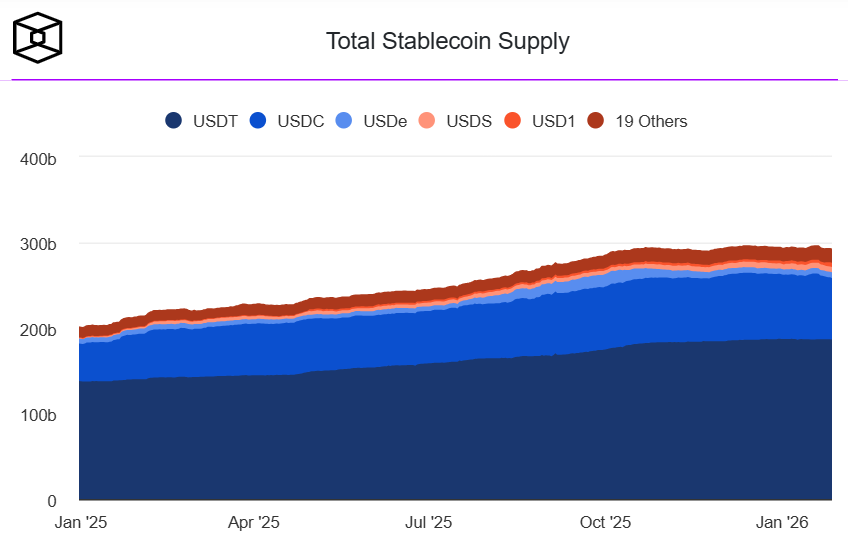

Unlike Tether’s flagship USDT,which is not available to U.S. customers despite a market supply of $187 billion USAT is explicitly designed for the American financial ecosystem. Anchorage Digital Bank acts as the issuer, while Cantor Fitzgerald serves as the reserve custodian and primary dealer, ensuring transparency and accountability.

Bo Hines former White House crypto policy advisor and now CEO of Tether USAT, emphasizes a focus on stability, governance, and regulatory compliance. Tether CEO Paolo Ardoino highlighted that USAT continues Tether’s mission to provide trust and utility at a federal scale.

Market Potential and Adoption

The launch coincides with growing interest from traditional financial institutions in stablecoins, which are increasingly seen as mainstream financial tools rather than experimental assets. Analysts predict that stablecoin adoption across banks could achieve a compound annual growth of 40%, signaling a new era of digital dollar integration in global finance.

USAT will be available on Bybit, Crypto.com, Kraken, OKX, and Moonpay, providing accessible entry points for U.S. users seeking regulated stablecoin exposure.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.