Tether, the issuer of the USDt stablecoin, reported record-high holdings of U.S. Treasuries in 2025 while posting a notable year-on-year decline in profits. The latest figures highlight a strategic shift toward conservative, highly liquid assets as stablecoin demand continues to expand globally.

Profits Fall Despite Asset Growth

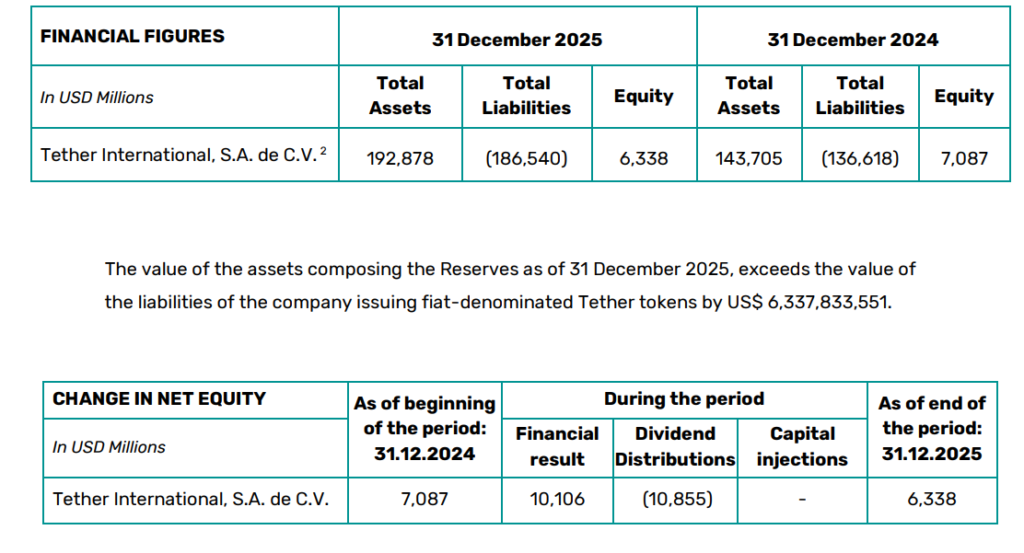

According to a financial report prepared by accounting firm BDO, Tether generated net profits exceeding $10 billion in 2025. This represents a decline of roughly 23% compared with the $13 billion reported in 2024. Despite lower profitability, the company’s overall balance sheet continued to strengthen, with total assets rising by more than $49 billion over the year.

Tether’s direct holdings of U.S. Treasury securities surpassed $122 billion in 2025, reaching the highest level in the company’s history. The increase reflects an ongoing move toward low-risk and highly liquid instruments to support USDt issuance and enhance reserve stability.

Stablecoin Demand Continues to Grow

Over the 12-month period, Tether issued approximately $50 billion in new USDt. The company attributed this growth to rising global demand for U.S. dollar exposure, particularly in regions with inefficient or inaccessible banking systems. USDt remains the third-largest cryptocurrency by market capitalization, playing a central role in trading, liquidity, and collateral across crypto markets.

Beyond Treasuries, Tether continues to hold significant gold reserves, including assets backing its gold-pegged XAUt token, reinforcing a diversified reserve strategy alongside its expanding Treasury portfolio.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.