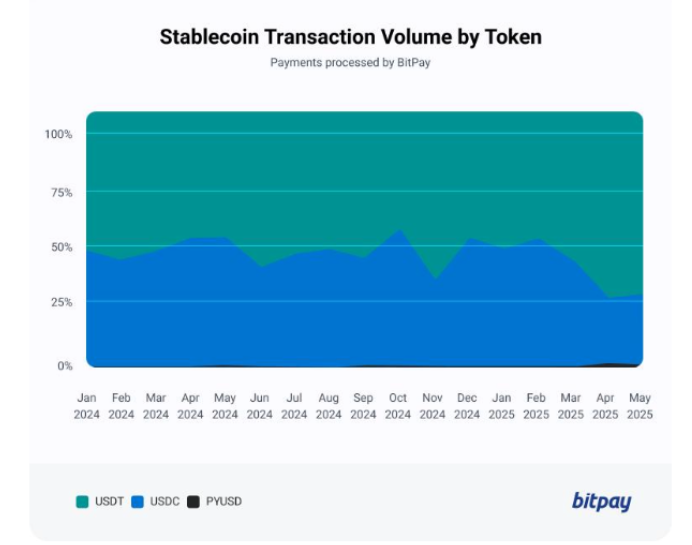

Tether’s USDT stablecoin is rapidly narrowing the gap with USDC on BitPay, one of the world’s leading crypto payment processors. In 2024, USDC dominated transactions on the platform, but 2025 has marked a significant shift in user preference.

USDT Gains Ground in BitPay Transactions

At the beginning of 2024, USDC accounted for 85% of stablecoin transactions on BitPay, while Tether’s share was only 13%. Fast forward to May 2025, and the numbers tell a different story:

- USDC’s share dropped to 56%

- USDT surged to 43%, showing an aggressive upward trend.

The shift highlights a growing preference among merchants and users for Tether’s USDT despite USDC’s early lead and regulatory advantages.

USDT Leads Stablecoin Payment Volume

While USDC still processes more individual transactions, Tether now dominates in terms of transaction volume. According to BitPay’s internal report:

“Since March 2025, USDT has consistently processed over 70% of all stablecoin payment volume.”

This means users may be using USDC for smaller payments, while USDT is now the preferred option for high-value transactions.

Why Are Users Choosing Tether Over USDC?

Several factors may explain the growing popularity of Tether’s USDT:

- Global familiarity and deep liquidity across platforms.

- Strong adoption in Asia, Latin America, and Africa, where BitPay is expanding.

- Resistance to MiCA compliance, allowing Tether more operational freedom outside Europe.

Despite Circle’s regulatory lead—having become the first stablecoin issuer authorized under the EU’s MiCA framework in July 2024—Tether’s simplicity and market-first approach continue to appeal to crypto users and merchants.

Tether CEO Paolo Ardoino recently confirmed that Tether will not pursue a public IPO or MiCA compliance, emphasizing its focus on global scale over regulatory concessions.

Stablecoin Market Cap Race Continues

According to CoinGecko, from July 2024 to July 2025:

- USDC’s market cap rose by 88%, from $33B to $61.7B.

- USDT grew by 40%, from $112.5B to $158.3B.

However, in 2025 alone, USDC’s market cap is up 41% year-to-date, while USDT’s has increased just 15.5%—suggesting USDC’s comeback remains possible.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.