Tether’s USDT, the largest stablecoin by market value, continued to expand rapidly in the fourth quarter of 2025 even as the broader crypto market faced a sharp downturn. New data shows that user adoption, reserves, and overall market presence strengthened during a period marked by heavy liquidations and falling asset prices.

USDT Market Capitalization and User Adoption

During Q4 2025, USDT’s market capitalization climbed to a new high of $187.3 billion, rising by $12.4 billion over the quarter. User growth was equally notable, with an estimated 35.2 million new users added, bringing total global users to approximately 534.5 million. This marked the eighth consecutive quarter in which USDT added more than 30 million users.

On-chain activity also increased. The number of on-chain holders rose by 14.7 million to 139.1 million, while USDT wallets accounted for 70.7% of all stablecoin wallets. Monthly active on-chain users averaged a record 24.8 million during the quarter. Tether estimates that more than 100 million users hold USDT through centralized platforms.

Reserves and Market Resilience

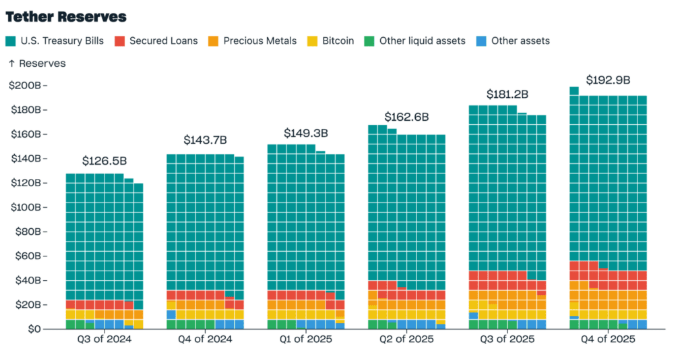

Tether’s total reserves grew by $11.7 billion in Q4, reaching $192.9 billion. These reserves included $141.6 billion in U.S. Treasuries, 96,184 BTC, and 127.5 metric tons of gold.

This growth occurred despite a major crypto liquidation event in October 2025 and a broader market decline of over one-third in total crypto capitalization. While overall stablecoin growth slowed, USDT still expanded by 3.5% during this period, highlighting its continued role as a preferred tool for value storage and transactions during market volatility.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.