The circulating supply of Tether (USDT) is on track for its steepest monthly contraction since late 2022, as blockchain data shows intensified redemptions from large holders.

USDT supply has fallen by roughly $1.5 billion in February, following a $1.2 billion decline in January. If the trend continues, it would mark the largest monthly drop since December 2022, when supply shrank by $2 billion in the aftermath of the FTX collapse.

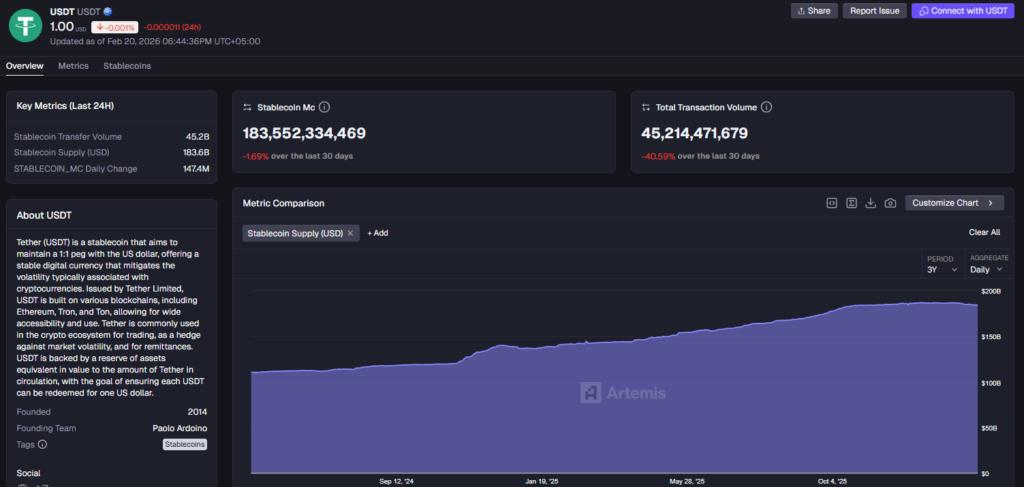

With a market capitalization near $183 billion, USDT accounts for approximately 71% of the global stablecoin market. Because it serves as a primary liquidity bridge between fiat and crypto markets, sustained supply reductions can signal tightening market liquidity conditions.

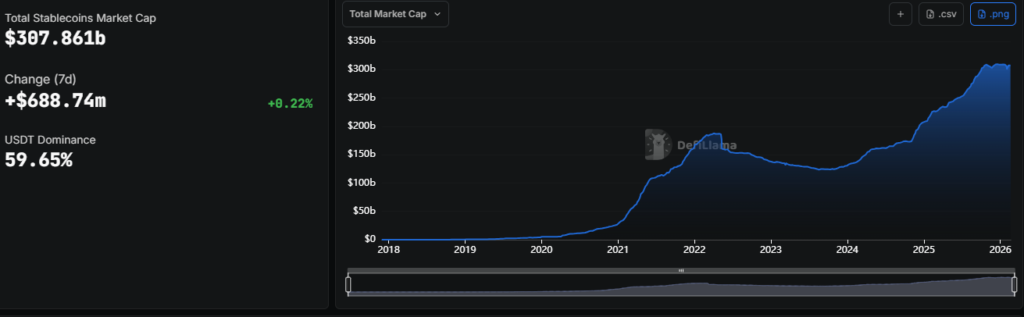

Stablecoin Market Remains Broadly Stable

Despite USDT’s pullback, the broader stablecoin sector has remained resilient. Total stablecoin market capitalization has risen about 2.3% in February, climbing from $300 billion to $307 billion. While USD Coin (USDC) also posted a modest decline, other issuers recorded growth, offsetting part of USDT’s contraction.

Whales Reduce Holdings as New Wallets Accumulate

Onchain analytics show whale wallets collectively sold nearly $70 million worth of USDT over the past week, increasing their pace of distribution. At the same time, newly created wallets accumulated roughly $591 million in USDT, suggesting fresh entrants are absorbing supply.

The mixed activity reflects a divided market, with large holders reducing exposure even as new participants step in, keeping overall stablecoin issuance relatively steady.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.