Texas Congressman Brandon Gill is under fire for failing to timely report up to $500,000 in Bitcoin transactions, raising questions about potential violations of the STOCK Act, a law designed to promote transparency among U.S. lawmakers.

Late Filings Violate 45-Day STOCK Act Deadline

Gill, a first-term Republican representative, disclosed two large Bitcoin purchases — each valued between $100,001 and $250,000 — made on January 29 and February 27. However, both trades were reported beyond the 45-day window mandated by the Stop Trading on Congressional Knowledge (STOCK) Act.

Late disclosures violate federal ethics law, which aims to prevent insider trading and financial conflicts of interest.

Adding to the controversy, Gill’s January 29 purchase came shortly after an executive order by Donald Trump supporting digital assets. The February 27 transaction preceded Trump’s announcement of a “strategic Bitcoin reserve.”

Timing Raises Ethical Concerns

Bitcoin prices during those trades ranged between $85,000 and $102,000. As of now, Bitcoin trades above $105,000, indicating a likely gain in value.

The timing of these transactions has raised red flags, as they align closely with influential political announcements.

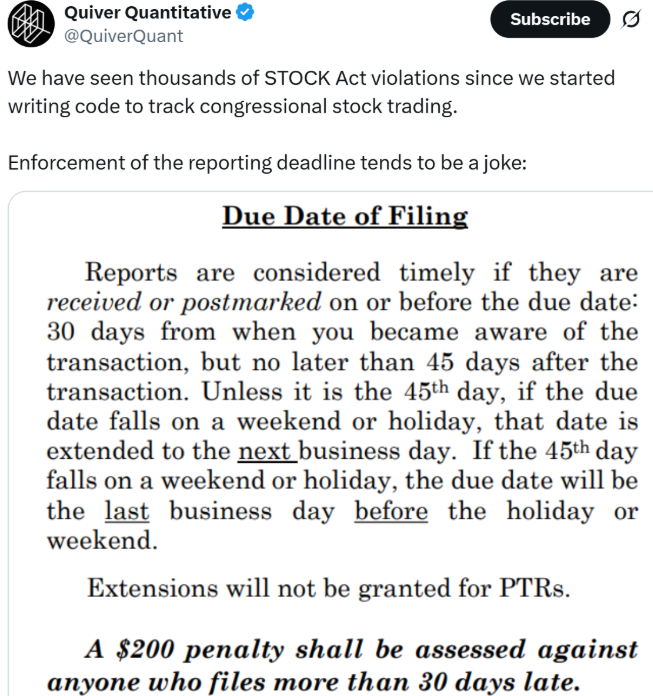

Despite the potential violations, the penalty for late STOCK Act filings is typically only $200, a fine that has been widely criticized as insufficient. A leading investment research firm called the penalty a “joke,” highlighting that thousands of similar violations have occurred without meaningful consequences.

Additional Trades Filed on Time

Gill’s recent disclosure also included two Bitcoin purchases from May, one for up to $250,000 and another for up to $100,000, both filed within the legal deadline.

He also reported investments in Invesco’s S&P 500 Equal Weight ETF (RSP) and TOIXX money market fund, which were disclosed properly.

Gill’s on-time filings suggest awareness of compliance, though his earlier lapses remain problematic.

Broader Context: Gill, Trump, and Crypto Advocacy

Brandon Gill has close ties to former President Donald Trump, being the son-in-law of conservative media figure Dinesh D’Souza. He also serves on the House Oversight, Judiciary, and Budget Committees, positioning him at the center of major policy decisions.

Gill is an outspoken advocate of cryptocurrency, describing it as “permission-less and peer-to-peer, like cash.” However, critics argue his advocacy may blur ethical lines given his personal investments.

Gill joins a growing list of lawmakers under scrutiny for STOCK Act violations, as calls intensify to ban congressional crypto and stock trading.