In the evolving world of digital assets, one message is becoming increasingly clear:

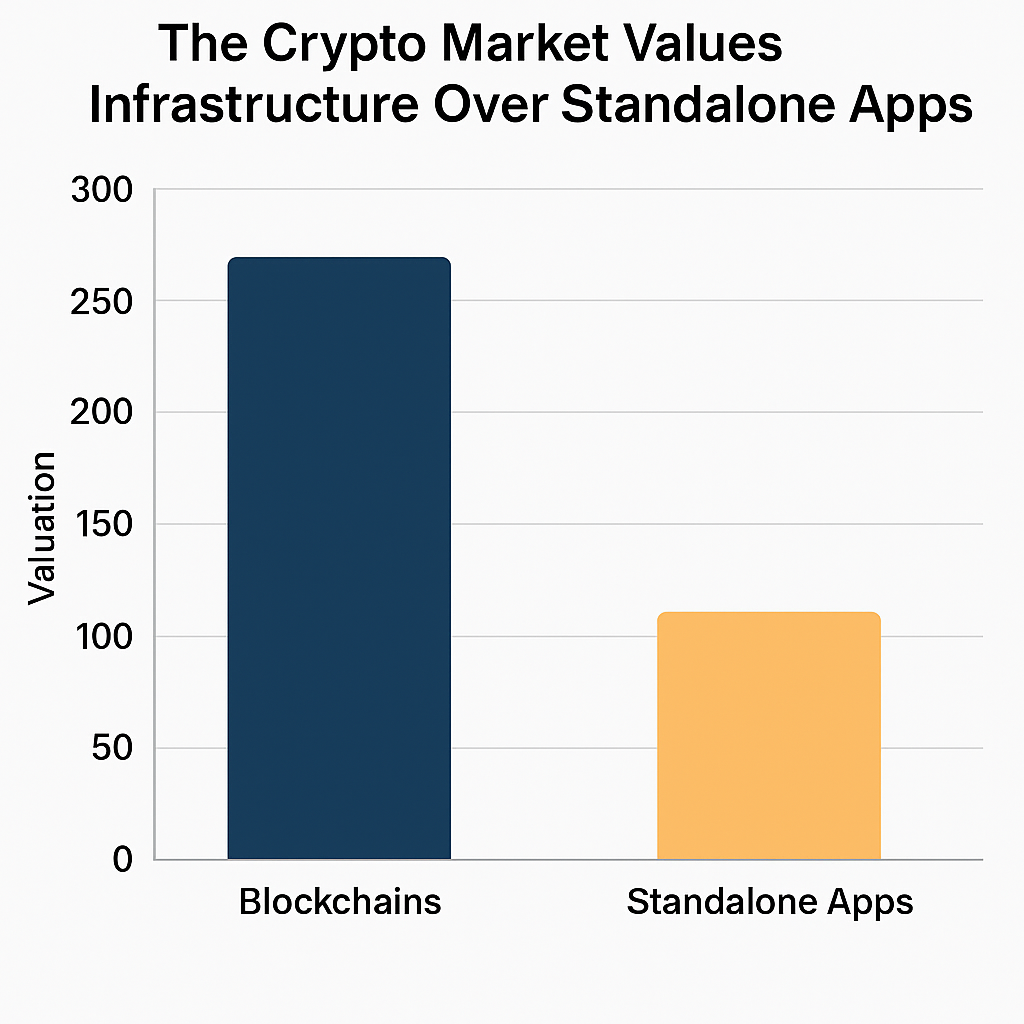

The crypto market places more value on Layer-1 and Layer-2 blockchains than on standalone applications.

Investors, developers, and users are showing greater long-term confidence in blockchain infrastructure that powers decentralized ecosystems rather than the apps built on top of them.

Chains Drive Ecosystem Growth

A Layer-1 or Layer-2 blockchain isn’t just a technology—it’s a foundation for future innovation.

Platforms like Ethereum, Solana, Avalanche, and Base are being treated as digital “nations” with massive potential for hosting financial, social, and gaming apps.

Key reasons why chains are prioritized:

- Scalability attracts builders

- Network effects create sticky ecosystems

- Token utility gives long-term value to chain-native assets

- Ecosystem incentives (airdrops, grants) attract developers

Standalone dApps Face Longevity Challenges

While decentralized applications (dApps) like Uniswap, Friend.tech, or StepN may attract viral attention, they often struggle with:

- User retention beyond initial hype

- Limited moats against copycats

- Over-dependence on the underlying chain’s performance

“Most dApps are only as strong as the blockchain they’re built on,” said a Web3 investor.

“But strong chains can survive even if individual apps fail.”

Smart Money Follows Infrastructure

Top venture capital firms and crypto-native funds have consistently backed infrastructure plays over single-use dApps.

Layer-1 and Layer-2 tokens often outperform application tokens in long-term market cycles, partly due to their broader utility and adoption potential.

Examples of strong chain-driven growth:

- Solana’s rise powered by its speed and developer community

- Ethereum Layer-2s like Optimism and Arbitrum gaining TVL and users

- Modular chains (e.g., Celestia) getting early traction

What This Means for Builders

If you’re launching a project in 2025, consider this:

Building infrastructure or middleware could offer more durable value than launching another social or trading app.

Communities and capital follow platforms, not just products. Ecosystem-first thinking might be the key to long-term survival and impact in Web3.

Conclusion

The crypto market is sending a clear signal:

Chains matter more than apps.

As the next wave of Web3 unfolds, infrastructure is emerging as the ultimate competitive advantage. Investors, developers, and users alike are placing their bets on platforms that enable others to build, scale, and thrive.