As South Korea’s crypto trading volumes collapse, retail investors are driving a historic rally in semiconductor and AI stocks, transforming the nation’s speculative energy into a state-backed market surge.

South Korea, once the beating heart of global crypto speculation, is witnessing a dramatic transformation. The collapse in trading volumes on Upbit and Bithumb—down nearly 80% year-over-year— marks the end of the country’s altcoin obsession. But instead of retreating from risk, millions of retail investors have pivoted to the stock market, fueling an explosive rally led by AI and semiconductor giants such as Samsung Electronics and SK hynix.

Crypto’s Decline and Market Silence

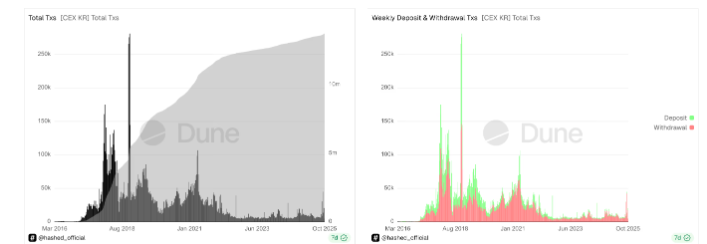

The country’s once-thriving digital asset exchanges have gone quiet. Upbit’s daily volume plunged from $9 billion in late 2024 to just $1.8 billion by November 2025, while Bithumb lost two-thirds of its liquidity over the same period. Even market volatility—once a defining feature of Korean crypto trading—has nearly vanished, with daily turnover stabilizing between $2 billion and $4 billion, a fraction of the wild swings seen in previous years.

Analytics firms report that exchange deposits have dropped nearly 80% since the 2018 peak, showing just how deeply retail traders have stepped away from digital assets.

The vacuum left by crypto has been filled by an equally speculative phenomenon: the AI-fueled equity rally. The KOSPI index surged over 70% in 2025, with October alone posting a 21% monthly gain, its strongest since 2001. Much of this momentum comes from AI semiconductor stocks, particularly Samsung Electronics and SK hynix, whose combined trading volume now accounts for over a quarter of total exchange activity.

A surge in new trading accounts—from 86.5 million to 95.3 million by late October— illustrates the sheer scale of retail participation. Analysts describe the phenomenon as a “policy-backed bull run”, supported by President Yoon Suk Yeol’s reforms aimed at reducing the “Korea Discount” and incentivizing domestic investment.

Same Spirit, New Market

The speculative DNA of Korean traders remains unchanged. Margin lending and leveraged ETFs are booming, with leveraged retail positions now making up 30% of total holdings. Younger investors, once fixated on memecoins, are now chasing AI chip stocks with the same intensity.

“This isn’t an exit from speculation—it’s an evolution,” noted one market strategist. “Koreans have simply moved their risk appetite from digital tokens to digital infrastructure.”

While AI and semiconductor stocks dominate Korea’s new financial narrative, the global crypto market is feeling the absence of its once-vital Korean liquidity. Memecoin rallies fade faster, and bitcoin’s price remains stagnant near $100,000 despite hitting new highs last month.

Still, history suggests a return is inevitable. As the AI trade cools or a new crypto catalyst emerges, Korea’s “Kimchi traders” could once again ignite digital markets. For now, they’ve merely changed arenas—swapping blockchains for circuit boards, but keeping the same speculative heartbeat.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.