The Smarter Web Company, a UK-based firm listed on the Aquis Stock Exchange, has made another significant move in its bitcoin treasury strategy by acquiring 230.05 BTC for $24.6 million, bringing its total holdings to 773.58 BTC.

Latest Bitcoin Buy Pushes Holdings Past $82 Million

The firm disclosed that it bought 230.05 BTC at an average price of $107,126 per bitcoin, slightly above the current market value of around $106,963. This brings the company’s total investment to $82.7 million, with an average entry price of approximately $107,015 per BTC.

The Smarter Web Company now ranks 36th among global public companies with the largest bitcoin treasuries, nearing the top 30.

From Web Design to Bitcoin Treasury Powerhouse

Originally a web design and digital marketing firm, The Smarter Web Company provides services such as website development, hosting, and SEO. In April 2025, it adopted a bitcoin treasury strategy, believing in BTC’s long-term value as part of the global financial system.

The firm started accepting bitcoin as payment in 2023 and has since pivoted its business strategy toward BTC accumulation and treasury growth.

The company’s transformation is guided by a 10-Year Plan focused on organic client growth, selective acquisitions, and strategic bitcoin purchases aimed at maximizing long-term shareholder value.

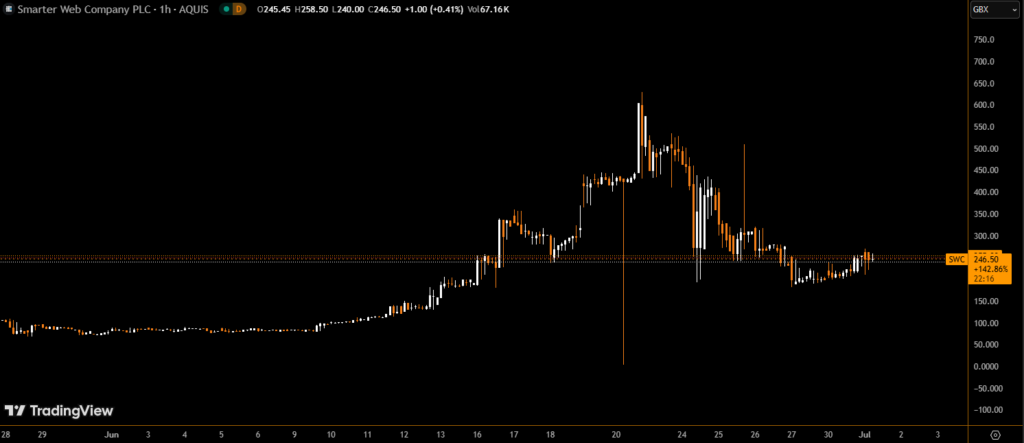

Massive Stock Surge Followed by Sharp Correction

After announcing its bitcoin strategy in April, SWC’s stock soared nearly 20,000%, briefly reaching £605 per share, taking its market cap above £1 billion ($1.4 billion) — higher than some FTSE-listed companies. However, the stock experienced a 70% correction last week, falling to £192, and has since rebounded to £249.75.

Despite the volatility, The Smarter Web Company remains the UK’s largest corporate bitcoin holder.

UK Bitcoin Treasury Movement Gains Steam

The company leads a growing list of UK-based firms adopting bitcoin treasury models. Others include:

- Phoenix Digital Assets – 247 BTC

- Coinsilium – 74 BTC

- CoinShares (Jersey-based) – 236 BTC

Concerns Over Corporate Crypto Exposure

While corporate bitcoin accumulation is on the rise, some experts have issued warnings. Coinbase Institutional has raised concerns about leveraged crypto exposure, while JAN3 CEO Samson Mow cautioned that companies led by inexperienced CEOs could collapse during market downturns.

Still, The Smarter Web Company’s rapid ascent and aggressive treasury growth reflect a bold bet on bitcoin as a reserve asset — positioning the company for future prominence in both tech and crypto finance.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.