Tian Ruixiang Holdings Ltd, a Nasdaq-listed insurance brokerage, announced plans to acquire up to 15,000 Bitcoin through an equity-linked agreement with an unnamed global digital asset investor. Under the proposed deal, the investor would contribute Bitcoin in exchange for an ownership stake in the company.

Based on Bitcoin trading near $75,000 at the time of the announcement, the potential contribution would be valued at approximately $1.1 billion. The company did not disclose details regarding transaction timing, custody arrangements, or settlement structure.

AI and Crypto Partnership Included in Agreement

In addition to the Bitcoin component, the agreement outlines a broader strategic partnership focused on artificial intelligence and digital asset development. Tian Ruixiang said the two parties plan to establish a joint innovation lab aimed at building AI-powered trading systems, risk management tools, blockchain infrastructure, and decentralized applications. Planned initiatives also span layer-2 networks, decentralized finance, and nonfungible token-related products.

The counterparty was described as a global investor with experience across cryptocurrency and technology markets, though no further identification was provided.

Market Reaction and Bitcoin Treasury Implications

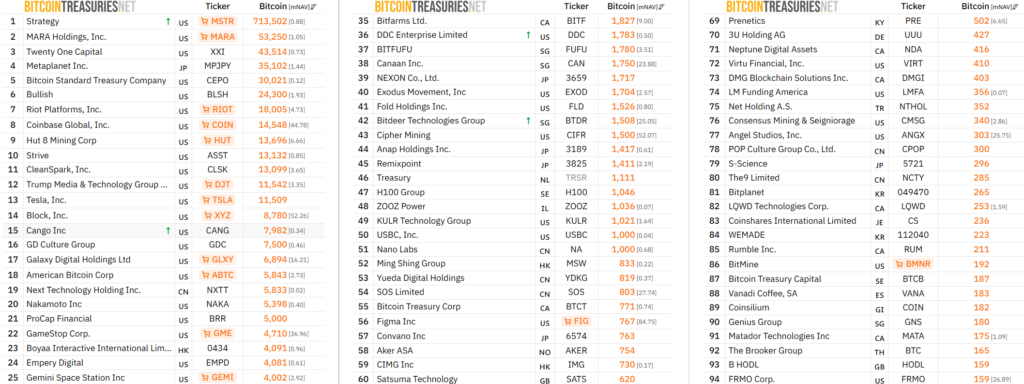

Following the announcement, Tian Ruixiang shares surged roughly 190% in early trading, briefly lifting the company’s market capitalization to about $9.5 million. If completed, the transaction would position Tian Ruixiang among the largest publicly traded companies holding Bitcoin, ranking around eighth globally by treasury size.

The announcement comes as publicly listed Bitcoin holders face pressure from recent market weakness, with several firms reporting unrealized losses amid declining prices.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.