Tokenization is emerging as a transformative solution for Latin America’s capital markets, aiming to resolve systemic inefficiencies and boost liquidity, according to a new Bitfinex Securities report.

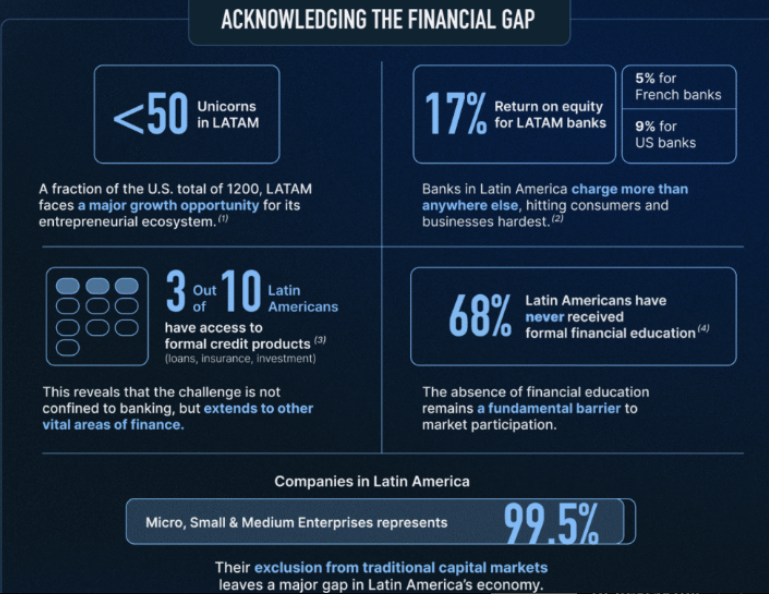

Latin America’s financial markets face persistent challenges, including:

- High transaction fees

- Complex regulatory frameworks

- Technological barriers and high startup costs

These issues contribute to a phenomenon known as “liquidity latency” — slowing capital flow and hindering investments in the region.

How Tokenization Solves Liquidity Problems

Tokenization, the process of converting real-world assets (RWAs) into blockchain-based tokens, offers a way to make financial markets more transparent, efficient, and inclusive.

According to Bitfinex Securities, tokenized financial products can:

- Cut issuance costs for capital raises by up to 4%

- Reduce listing times by as much as 90 days

- Expand investor access to high-value assets globally

Jesse Knutson, Head of Operations at Bitfinex Securities, emphasized:

“Tokenization represents the first genuine opportunity in generations to rethink finance. It lowers costs, accelerates access, and creates a more direct connection between issuers and investors.”

Bridging the Financial Gap with Blockchain

Bitfinex highlights that tokenization could remove barriers for businesses and individuals in emerging economies, who have long faced difficulties accessing capital through traditional markets.

Paolo Ardoino, CEO of Tether and CTO of Bitfinex Securities, stated:

“For decades, businesses and individuals, particularly in emerging economies, have struggled to access capital through legacy markets. Tokenization actively removes these barriers.”

Tokenized products can offer higher-yielding, fully compliant investment opportunities, improving financial inclusion across Latin America.

A Multi-Trillion Dollar Opportunity

According to McKinsey, tokenized securities could reach $1.8 trillion to $3 trillion by 2030. Bitfinex, which received El Salvador’s first digital asset service provider license, has already issued tokenized U.S. Treasury bills to enable users to hedge savings against the U.S. dollar.

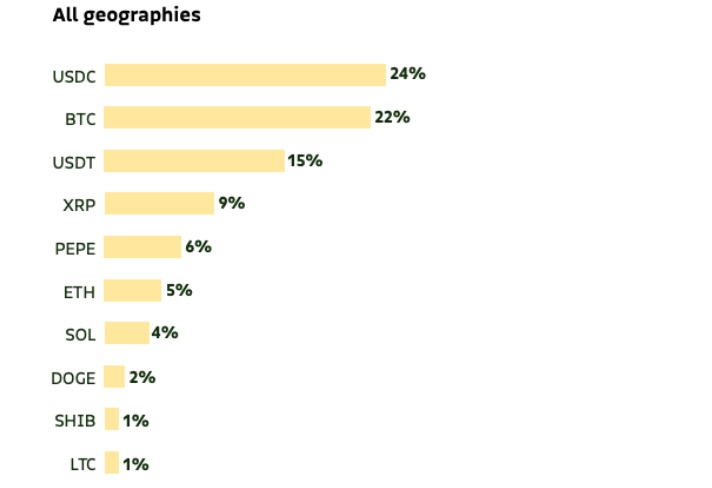

Latin Americans are increasingly turning to cryptocurrencies and stablecoins for financial stability. Data from Bitso shows that stablecoins like USDT and USDC accounted for 39% of total purchases in 2024, becoming a preferred store of value amid inflation and currency volatility.

Tokenization could revolutionize Latin America’s capital markets, breaking down barriers to capital, improving efficiency, and creating a new era of financial inclusion powered by blockchain technology.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.