The tokenized commodities market has climbed above $6.1 billion in value, marking a 53% increase in less than six weeks and emerging as the fastest-growing segment within the real-world asset tokenization sector. The sharp rise has been largely fueled by growing demand for tokenized gold as bullion prices rally to historic highs.

Tokenized Gold Dominates Market Growth

At the start of the year, the tokenized commodities market was valued at just over $4 billion, meaning nearly $2 billion has been added since January 1. Gold-backed digital assets account for the overwhelming majority of that growth.

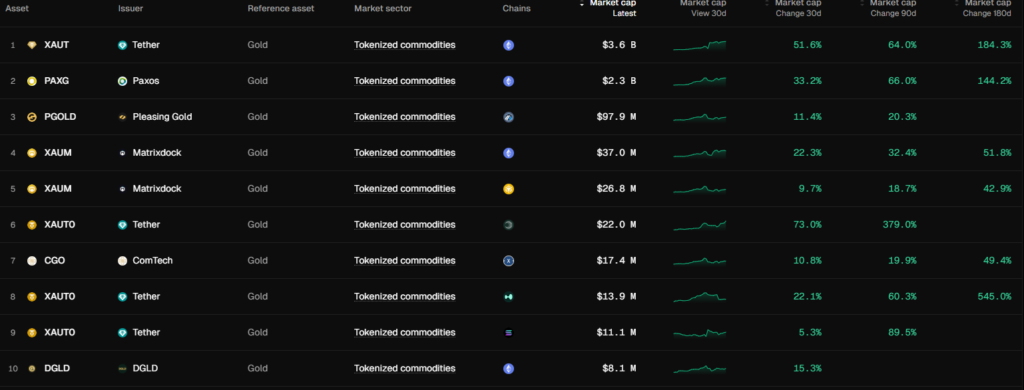

Tether Gold (XAUt) leads the sector, with its market capitalization rising 51.6% over the past month to reach $3.6 billion. Paxos-issued PAX Gold (PAXG) followed with a 33.2% increase, bringing its market cap to $2.3 billion. Together, the two tokens represent more than 95% of the total tokenized commodities market.

On a yearly basis, tokenized commodities have expanded 360%, outpacing tokenized stocks, valued at $538 million, and tokenized funds, which stand at $17.2 billion after modest growth this year.

Gold Rally Drives Onchain Demand

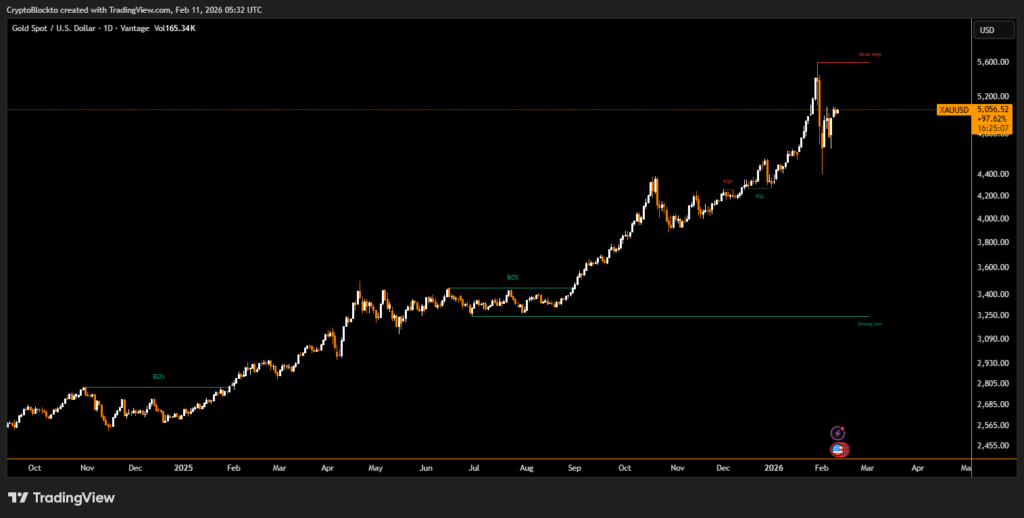

The surge in tokenized gold mirrors the broader rally in physical gold markets. Spot gold prices have climbed more than 80% over the past year, reaching an all-time high of $5,600 on January 29. After briefly retracing to $4,700, gold has rebounded to around $5,050.

Meanwhile, Bitcoin remains below its previous highs after falling more than 50% from its October peak, reinforcing gold’s appeal as a traditional safe-haven asset during market volatility.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.