Analyst Still Expects BTC Above $100K but Calls New All-Time High Only a “Maybe”

Bitcoin’s long-time bull Tom Lee has dialed back his most aggressive forecast, easing off his widely publicized call for $250,000 BTC by the end of 2025. In a recent interview, Lee said Bitcoin could still finish the year above $100,000, but a surge to a new all-time high is now simply a “maybe.”

Bullish Target Reduced as Market Weakness Lingers

Lee, who chairs BitMine, has been among the strongest voices predicting a parabolic Bitcoin rally. His shift comes after a volatile month for the crypto market, where Bitcoin fell sharply following a $19 billion liquidation event tied to global macro uncertainty.

For the first time since early 2024, Lee stopped explicitly endorsing his $250K target, acknowledging that the market’s path has become less predictable.

New High Possible but Far From Guaranteed

During the interview, Lee explained:

“It’s still very likely Bitcoin is going to be above $100,000 before year-end, and maybe even to a new high.”

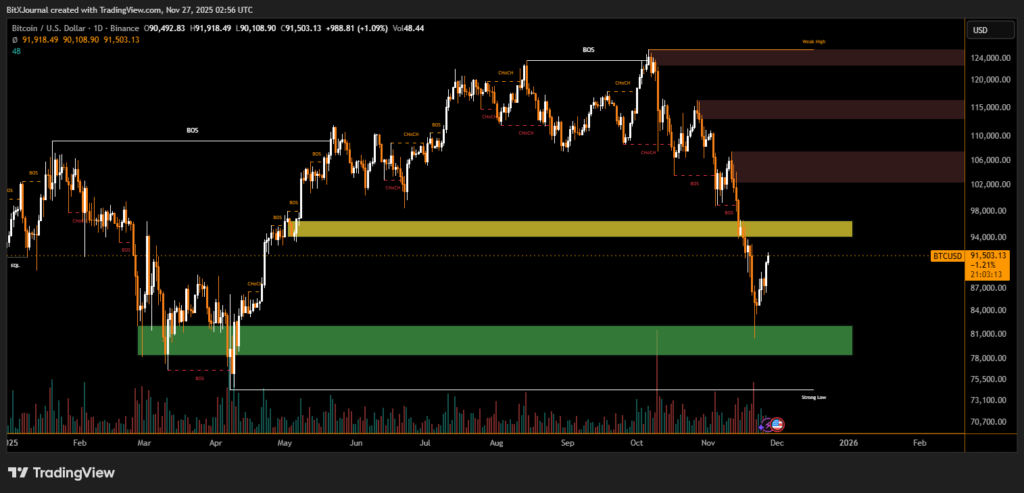

His comments reflect a more cautious tone compared to the optimism he expressed earlier in the year. Bitcoin previously reached an all-time high of $125,100 in October but has since retreated, now trading around the lower $90K range.

Despite the pullback, Lee believes several of BTC’s strongest sessions may occur before the end of 2025, noting the asset’s tendency to generate outsized gains in a small number of trading days.

Industry data supports that pattern. Analysts point to Bitcoin’s historical behavior where missing the top 10 strongest days often means missing nearly all annual returns. This year alone, BTC’s best 10 days delivered 52% combined gains, while the remaining days averaged –15% performance.

Liquidations and Macro Headlines Weigh on Price

Bitcoin has been trending downward since Oct. 10, pressured heavily by macro headlines including a proposed 100% tariff on Chinese imports. The sell-off kept BTC under $90,000 for nearly a week before buyers reclaimed the level on Wednesday.

Seasonality adds more complexity: November is historically Bitcoin’s strongest month dating back to 2013, yet this year’s action has been muted.

Economist Timothy Peterson recently suggested that Bitcoin’s bottom may have already formed—or is forming this week—setting the stage for a potential recovery phase.

Lee’s Past Bitcoin Calls Have Been Mixed

Lee’s predictions have seen both successes and misses.

Notably, his 2018 expectation that Bitcoin could hit $125,000 by 2022 did not materialize, with that year’s peak reaching only $17,172.

However, earlier forecasts proved more accurate: in 2017, he projected BTC could reach $20,000–$55,000 by 2022, a range Bitcoin ultimately achieved between December 2020 and March 2021.

As the market heads into the final stretch of 2025, Lee maintains that Bitcoin’s “best days are still ahead,” even if the path to $250K now appears less certain.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.