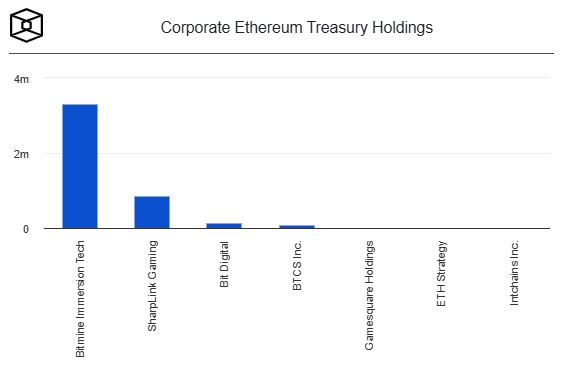

Firm’s ETH Holdings Surpass 3.3 Million, Strengthening Position as World’s Largest Ethereum Treasury

BitMine Immersion Technologies, the digital asset treasury firm founded by Tom Lee, has reportedly acquired $113 million worth of Ethereum (ETH) this week, according to on-chain data. The purchase reinforces BitMine’s status as the largest Ethereum-holding institution globally, now controlling over 3.3 million ETH valued at approximately $13.2 billion.

Blockchain tracking platform Lookonchain, citing Arkham Intelligence data, identified a transaction from wallet “0xDc8…3a07f” linked to BitMine, showing the transfer of 27,316 ETH from custody provider BitGo on Tuesday. Although BitMine has not yet confirmed the transaction publicly, the movement aligns with the firm’s previously announced accumulation targets.

BitMine Targets 5% of Ethereum Supply

On Monday, BitMine disclosed that its corporate treasury had exceeded the 3.3 million ETH milestone, placing it just behind Michael Saylor’s Strategy as the second-largest crypto treasury overall. The firm aims to eventually accumulate 5% of Ethereum’s total circulating supply, signaling its long-term conviction in the network’s role in global finance.

“Our commitment to Ethereum reflects its growing importance in institutional finance and the tokenization of real-world assets,” BitMine said in a recent statement, reaffirming plans to expand holdings through custodial partnerships and staking operations.

BitMine’s institutional backers include Ark Invest’s Cathie Wood, Bill Miller III, Digital Currency Group (DCG), Founders Fund, Galaxy Digital, Kraken, and Pantera Capital — underscoring broad institutional confidence in Ethereum’s future.

Tom Lee: Ethereum as Wall Street’s “Neutral Chain”

Tom Lee, co-founder of Fundstrat Global Advisors, has consistently positioned Ethereum as the most adaptable and policy-neutral blockchain for large-scale financial systems.

“Wall Street and the White House will increasingly favor Ethereum for blockchain adoption because it’s a truly neutral chain,” Lee remarked in a recent interview.

At the time of writing, Ethereum trades near $4,000, down 2.3% in the past 24 hours, reflecting short-term volatility amid broader crypto market fluctuations.

BitMine’s latest acquisition further cements Ethereum’s dominance in institutional portfolios and highlights the ongoing convergence between blockchain infrastructure and traditional finance.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.