Telegram’s TON Token Hit Hard by Geopolitical Shock

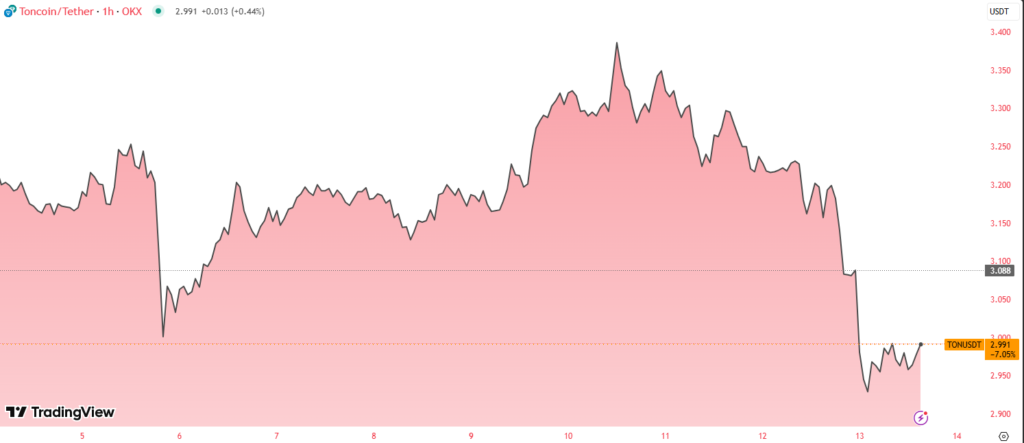

Telegram’s native token, TON, dropped sharply by 8.4% in 24 hours, falling from $3.20 to $2.93, as global markets reacted to heightened tensions in the Middle East. The price correction came after Israeli airstrikes targeted Iranian military facilities and leadership, igniting risk-off sentiment across digital assets.

TON was among the hardest-hit assets, compared to a broader 6.2% drop across the top 20 non-stablecoin cryptocurrencies.

As of the latest market data, TON has shown a mild recovery to $2.96, suggesting some degree of price stabilization.

Technical Analysis: Support and Resistance Zones Emerging

The technical chart data highlights key trading behavior during the correction:

- Price dropped from $3.20 to $2.93, reflecting heightened selling pressure and emotional trading during geopolitical uncertainty.

- A volume spike of 3.36 million tokens established a strong resistance level around $3.09.

- A significant 7.74 million token volume surge created a high-volume support zone at approximately $2.94.

- Current price consolidation between $2.95–$2.99 suggests buying interest at lower levels.

- 284,843 units traded at the $2.96 level indicates support from active buyers, as minor dips are being absorbed quickly.

These technical signals point to a possible short-term base forming near $2.94, with limited downside unless broader market volatility increases.

Market Sentiment: Resilience Despite Geopolitical Pressure

Despite the steep correction, TON’s relatively quick recovery highlights resilient investor confidence in Telegram’s growing crypto ecosystem. TON’s DeFi and app integrations have steadily expanded, and many traders view this dip as a potential accumulation zone.

The price action following the drop indicates that TON is stabilizing and may see further strength if geopolitical tensions ease.

Still, ongoing geopolitical risks and volatility in global markets may continue to affect short-term price movements. Traders should watch for confirmation of support above $2.94 and a breakout above $3.09 before expecting any trend reversal.

summary

TON’s 8% decline was driven by external macro events rather than internal weakness. With strong support levels and active volume zones identified, the asset may be preparing for a gradual rebound—but risk remains elevated.