TON shows tentative support as funding rates flip positive but price remains pinned below key resistance zones

Toncoin continues to trail behind the broader crypto rebound, with price action on the daily chart showing a controlled but fragile attempt to stabilize. While several major altcoins have reclaimed earlier losses, TON remains locked beneath multiple overhead supply zones, signaling that buyers have yet to regain meaningful dominance.

However, derivatives metrics introduce a more optimistic undertone. Altcoin funding rates, including Toncoin’s, have shifted into positive territory, suggesting traders are cautiously rebuilding long exposure.

TON Faces Heavy Overhead Resistance

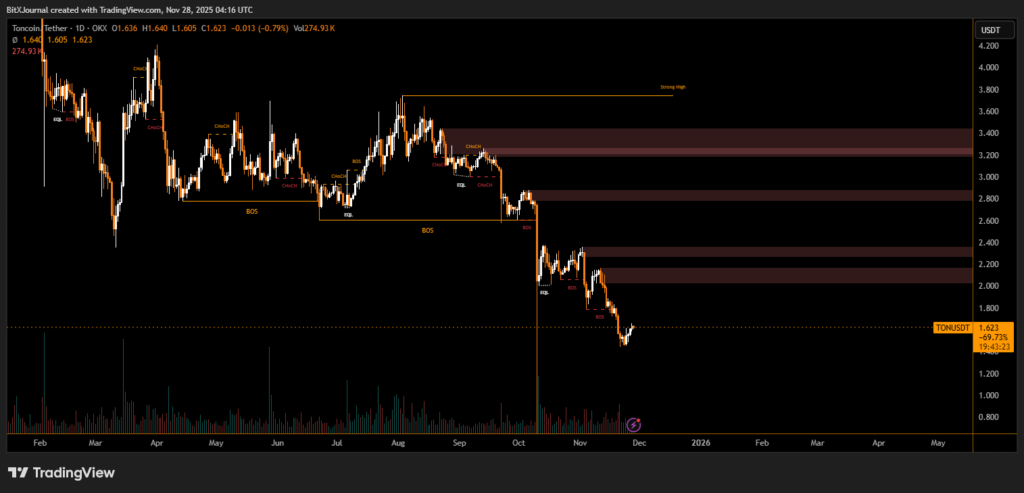

The provided chart shows TON trading around the $1.62 level, down sharply from its mid-year highs. The token has repeatedly failed to break into any of the stacked supply regions between $2.20 and $3.40, reflecting persistent selling pressure after months of structural weakness.

A series of break of structure (BOS) labels across the chart illustrates a clean downward trend, with Toncoin marking lower highs and lower lows throughout late 2025. The latest BOS near early November confirms the continuation of this bearish sequence.

BitXJournal Analysts observed that “the price remains suppressed beneath several unmitigated supply blocks. Until one of these is cleared with conviction, upside moves will likely be corrective rather than trend defining.”

He added that “the $1.50–$1.60 region is where early buyers are attempting to defend, but the reaction so far lacks the impulsiveness seen in stronger assets this week.”

Derivatives Data Hints at Growing Confidence

Despite the muted spot performance, derivatives markets show subtle improvement. The shift to positive funding rates indicates that traders are increasingly willing to pay to maintain long positions. This typically reflects early confidence during bottom-formation phases.

Market researcher Elena Harrow explained that “funding turning positive for TON is noteworthy because it comes after an extended period of negative sentiment. It shows that a portion of the market is positioning for a potential recovery.”

Still, she cautioned that “without a break above the first resistance band near $2.00, this remains a speculative bounce rather than a confirmed reversal.”

For now, Toncoin must maintain support above current levels to avoid another structural breakdown. A close above the early supply zones would be the first sign of a meaningful trend shift.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.