Tornado Cash (TORN) saw a near 5% price increase on Monday, rising from $9.16 to $9.67, following a pivotal decision from the Eleventh Circuit Court of Appeals. The court ruled in favor of dismissing a lawsuit filed against the U.S. Treasury Department, marking a major legal milestone for the privacy-focused protocol.

The court’s decision followed the Office of Foreign Assets Control’s (OFAC) earlier removal of Tornado Cash from its sanctions list, effectively ending a contentious regulatory chapter.

Coin Center Lawsuit Comes to a Close

The lawsuit in question was brought by Coin Center, a crypto policy advocacy group, challenging the U.S. government’s authority to impose sanctions on open-source software like Tornado Cash. After multiple legal extensions and evolving court rulings, both Coin Center and the Treasury agreed to jointly request the case be vacated and dismissed.

OFAC officially rescinded its sanctions against Tornado Cash in March 2025, following a Fifth Circuit decision which ruled that smart contracts themselves cannot be sanctioned.

Why the TORN Price Reacted

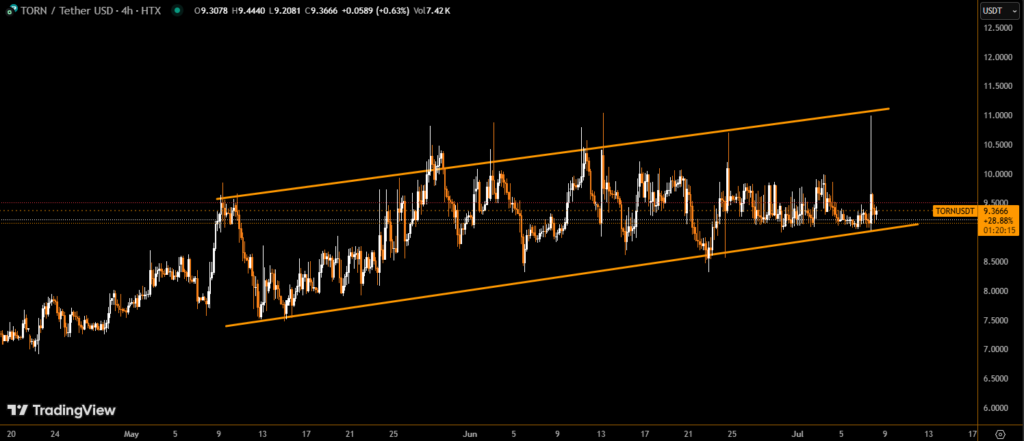

The TORN token responded immediately to the legal victory, as the news spread across social media and crypto trading forums. Investors interpreted the ruling as a bullish signal for the project’s legitimacy and long-term viability.

- Price before the ruling: $9.16

- Price after news spread: $9.67

- 24-hour increase: 5.57%

- Volume surge: High, driven by social media momentum

This legal outcome provides greater clarity for decentralized applications, particularly those offering privacy-enhancing tools.

Legal Uncertainty Still Looms for Developers

Despite the regulatory win, the U.S. government continues to pursue criminal charges against Tornado Cash developers Roman Storm and Roman Semenov, alleging money laundering violations. These criminal proceedings remain ongoing and could influence future token sentiment.

The legal distinction between smart contract software and the developers behind it remains a gray area, and is now at the heart of the ongoing criminal cases.

Final Thoughts: Is TORN Set for Recovery?

With the sanctions case now dismissed, TORN may see renewed investor interest, especially if trading volumes remain elevated. However, regulatory pressure is far from over, and ongoing legal risks could create future volatility.

While the recent price spike is promising, traders should monitor legal updates before interpreting this as a full-scale reversal.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.