Trend Research has significantly reduced its Ether holdings as falling prices pushed the investment firm closer to key liquidation thresholds.

Trend Research Cuts Ether Exposure Amid Market Decline

Over the past week, Trend Research offloaded more than 400,000 ETH, reducing its holdings from roughly 651,000 Ether to about 247,000 ETH. On-chain data shows that more than 411,000 ETH was transferred to major exchanges since the start of the month, signaling active deleveraging as market conditions deteriorated.

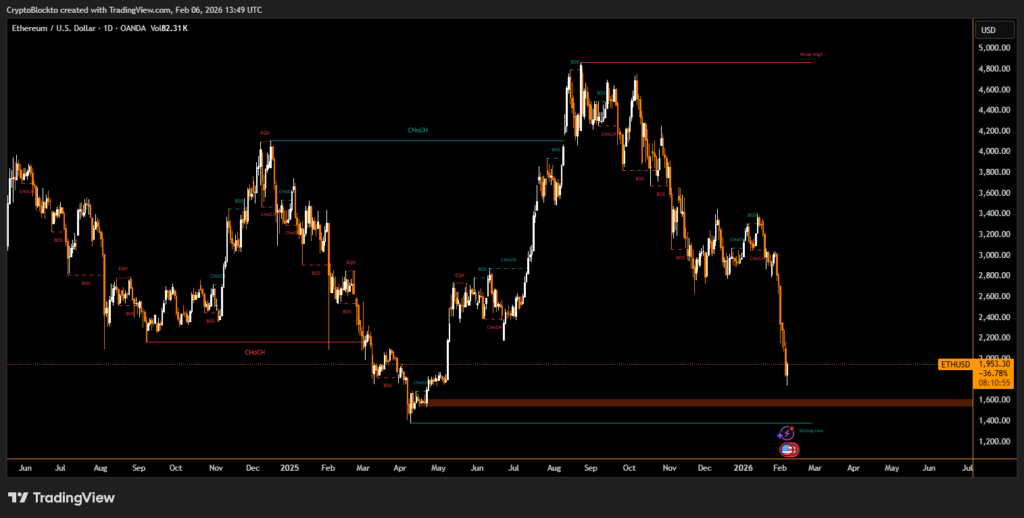

The sell-off coincided with a sharp drop in Ether’s price, which fell nearly 30% over seven days and briefly touched levels near $1,750 before rebounding closer to $2,000. The decline placed pressure on leveraged positions tied to decentralized lending platforms.

Approaching Liquidation Levels Drive Risk Management

Trend Research built its Ether position using a leveraged strategy, depositing ETH as collateral to borrow stablecoins and reinvesting those funds to acquire additional Ether. According to blockchain analysts, the firm faces multiple liquidation levels ranging between approximately $1,700 and $1,560.

In recent public comments, leadership acknowledged misjudging the market bottom but emphasized continued long-term confidence in Ethereum while prioritizing risk control during heightened volatility.

The firm rose to prominence following aggressive Ether accumulation after the large-scale crypto liquidations of late 2025. At its peak, Trend Research would have ranked among the largest ETH holders globally, though its private status keeps it off most public rankings.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.