In a significant development for the stablecoin ecosystem, Tether (USDT) on the TRON blockchain has once again overtaken Ethereum’s USDT supply, breaking a six-month pattern. This shift reflects changing user preferences driven by transaction speed, cost-efficiency, and growing adoption in cost-sensitive regions.

Stablecoins Across Blockchains: A Quick Overview

Tether (USDT) is the largest stablecoin in the world and is issued on multiple blockchains such as Ethereum, TRON, Binance Smart Chain, and Solana. While the token value remains pegged to the U.S. dollar across chains, the user experience varies significantly depending on the network.

Ethereum has long dominated due to its smart contract capabilities and first-mover advantage. However, high fees and congestion have become recurring pain points, prompting users to explore alternatives like TRON, which offers lower costs and faster transactions.

Why Is TRON USDT Gaining Traction?

TRON’s growing dominance in USDT circulation can be attributed to several key factors:

- Low Fees: TRON’s minimal transaction costs make it ideal for frequent and smaller transfers, especially in regions with limited banking infrastructure.

- High Throughput: The TRON network confirms transactions within seconds, offering a better user experience compared to Ethereum’s slower confirmation times.

- Adoption in Emerging Markets: TRON is especially popular in countries across Asia, Africa, and Latin America, where stablecoins are used for savings, payments, and remittances.

This combination of affordability and speed makes TRON the preferred blockchain for users focused on day-to-day transactions rather than advanced smart contract functionality.

Recent Data: USDT Supply Breakdown

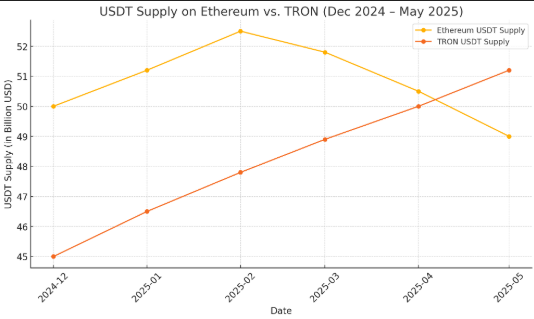

As of mid-May 2025, blockchain analytics show:

- USDT on TRON: Over $51 billion

- USDT on Ethereum: Approximately $49 billion

- Total USDT Supply (across all blockchains): Exceeds $110 billion

This reversal marks the first time since late 2024 that TRON leads Ethereum in circulating USDT. The last time TRON held the top spot was about six months ago, highlighting the fluctuating nature of stablecoin activity across networks.

User Behavior Signals a Broader Trend

This shift also reflects a larger pattern in the crypto space. Users are becoming more utility-driven, selecting networks based on efficiency, cost, and accessibility, rather than sticking to one ecosystem.

Ethereum still leads in decentralized applications (dApps), NFTs, and complex DeFi protocols. However, for stablecoin transfers — especially for payments or remittances — TRON is winning favor due to its superior transaction economics.

Exchanges and wallets have also contributed to this shift by prioritizing TRON-based USDT withdrawals because of reduced fee liabilities, encouraging broader user adoption.

What This Means for Ethereum and the Market

Ethereum’s decline in USDT dominance might result in less congestion, potentially lowering gas fees. It also gives Ethereum more room to optimize its network for other high-value use cases like staking, Layer 2 scaling, and enterprise applications.

For TRON, the milestone confirms its position as a leading transaction layer for stablecoin movement. As stablecoin utility expands globally, TRON’s architecture could continue to attract volume — especially from mobile-first and financially underserved regions.

Conclusion

TRON surpassing Ethereum in USDT circulation for the first time in six months reflects an evolving user landscape. With lower fees and faster speeds, TRON is becoming the go-to blockchain for stablecoin transfers. This trend may shape how developers and users interact with blockchain platforms in the coming months.