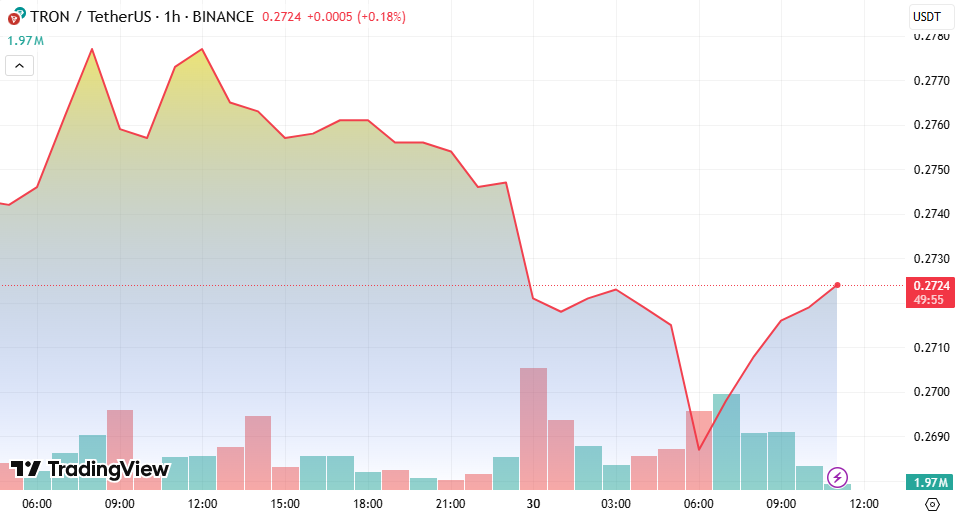

TRX Price Movement Signals Bearish Trend

Tron’s native cryptocurrency, TRX, has recently experienced a sharp decline, dropping from $0.277 to $0.270 within a 24-hour period. This represents a 2.5% loss amid broader market volatility. The price fluctuation between $0.278 (high) and $0.268 (low) highlights rising uncertainty among traders and investors.

This drop was accompanied by a trading volume surge exceeding 156 million TRX tokens, indicating intensified selling pressure.

Macroeconomic Factors Impacting TRX

The decline in TRX price comes as geopolitical tensions and trade policy changes continue to influence global markets. These macro-level uncertainties are affecting not only traditional assets but also the cryptocurrency sector, which is particularly sensitive to shifts in investor sentiment.

The broader crypto market is facing turbulence, with Bitcoin and other major altcoins also retreating, creating a ripple effect on TRX.

Support and Resistance Levels

Despite the downward movement, short-term support for TRX appears to be holding near the $0.268–$0.270 range. Buyers stepped in as the price briefly dipped below $0.27, causing a minor rebound.

This area now serves as a key technical support level, which could help limit further downside in the short term.

On the upside, resistance is forming near the $0.277 level, where sellers have consistently emerged during intraday rallies. Breaking above this resistance is essential for any bullish reversal to take place.

Technical Indicators and Trend Outlook

TRX is showing signs of forming lower highs, a classic indicator of bearish momentum. The pattern suggests continued downward pressure unless market dynamics shift in favor of buyers.

If TRX fails to maintain support above $0.270, a further drop toward the $0.260 mark cannot be ruled out.

Volume analysis also confirms the dominance of sellers, as the spike in trading activity corresponds directly with price declines.

Conclusion

Tron (TRX) is currently trading under bearish sentiment, influenced by both macroeconomic concerns and technical weakness. While strong volume indicates active market participation, it also reflects growing pressure on the downside.

The $0.270 level remains critical in determining the next direction for TRX. A break below this could signal a continuation of the downward trend, while holding above it may offer a temporary stabilization.