Tron (TRX) is making waves again as its price jumped 1.25% in the last 24 hours, breaking out of a tight consolidation range and entering a new zone of bullish activity. The surge comes amid heightened global economic uncertainty, with investors increasingly turning to blockchain-based assets like TRX for stability and upside potential.

TRX found strong buying pressure near $0.115, a level that’s quickly become a high-volume support zone for traders.

The bounce has sparked renewed optimism among retail and institutional holders alike.

Global Tensions Create Market Headwinds — but Crypto Seeks Asylum

As US-China trade tensions intensify, investors are fleeing riskier traditional markets. New tariffs on Chinese tech and EVs, coupled with retaliatory measures, are rattling global supply chains and creating a spillover effect into the crypto space.

“Tariff threats are fueling global uncertainty, but TRX is showing resilience,” said crypto analyst Jordan Myles.

While equity markets struggle, TRX’s price action is becoming increasingly uncorrelated, making it a potential safe-haven play for savvy investors.

Institutional Interest Rises as Central Banks Signal Policy Shifts

Institutional interest in TRX is surging, as central banks signal a potential shift in monetary policy amid persistent inflation. Markets are particularly eyeing the Federal Reserve’s upcoming statement, which could hint at rate cuts or continued tightening.

“Institutions are rotating into mid-cap crypto like TRX as a hedge against fiat devaluation and global currency risks,” noted a report from IntoTheBlock.

Whale activity on the Tron network is up 6% week-over-week, reflecting accumulation at current price levels.

Geopolitical Conflicts Drive Investors to Crypto

Ongoing conflicts in Eastern Europe and the Middle East are disrupting energy markets, causing commodity volatility and economic instability. In response, investors are diversifying into cryptocurrencies perceived as less vulnerable to centralized control or global conflict.

TRX, with its growing DeFi ecosystem and stable transaction volume, is emerging as a top choice for capital preservation.

Increased on-chain activity shows rising user engagement, especially in Asia-based markets.

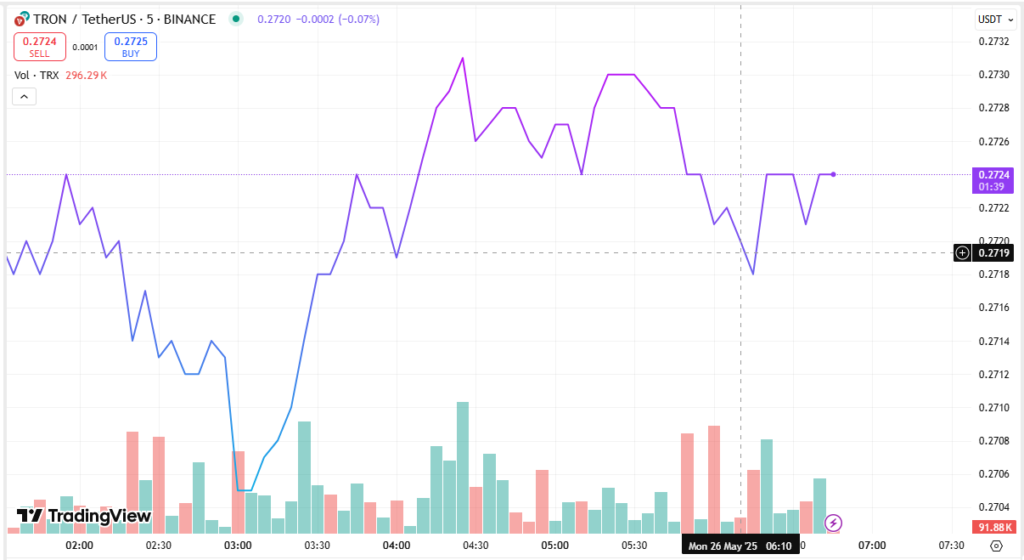

TRX Trading Outlook: Can the Rally Sustain?

With strong support at $0.115 and growing macro tailwinds, analysts are now targeting $0.125–$0.13 as the next resistance zone. Volume indicators remain bullish, and RSI levels are still far from overbought territory.

If momentum holds, TRX could outperform other altcoins in the short-term, especially if geopolitical tensions and inflation fears persist.