Turkey is taking a decisive step toward tighter crypto oversight. On June 25, the country’s Finance Ministry unveiled a proposal to implement stricter regulations on crypto platforms, targeting transparency, security, and international alignment.

New Compliance Measures: Source and Purpose Checks

According to state-backed Anadolu Agency, the new rules will require crypto platforms in Turkey to:

- Collect detailed information on the source and purpose of every transfer.

- Mandate users to provide transaction descriptions of at least 20 characters.

- Introduce holding periods:

- 48-hour delay for most crypto withdrawals.

- 72-hour delay for first-time withdrawals on new accounts.

The aim is to prevent money laundering, fraud, and illegal betting transactions while maintaining the legal use of crypto.

Stablecoin Transfers Face Strict Daily and Monthly Limits

A core part of the plan targets stablecoin transactions, which are often used for fast capital movement:

- Daily limit: $3,000

- Monthly limit: $50,000

Platforms that fully comply with the Travel Rule can offer double the limits, provided they verify both sender and recipient identities.

Transfers linked to liquidity provision, arbitrage, and market making will be exempt—if the platform can prove fund legitimacy and assumes monitoring responsibility.

Turkey Aligns With Global Crypto Standards

This move is part of Turkey’s broader effort to align with international regulatory frameworks, especially the EU’s MiCA (Markets in Crypto-Assets) regulation.

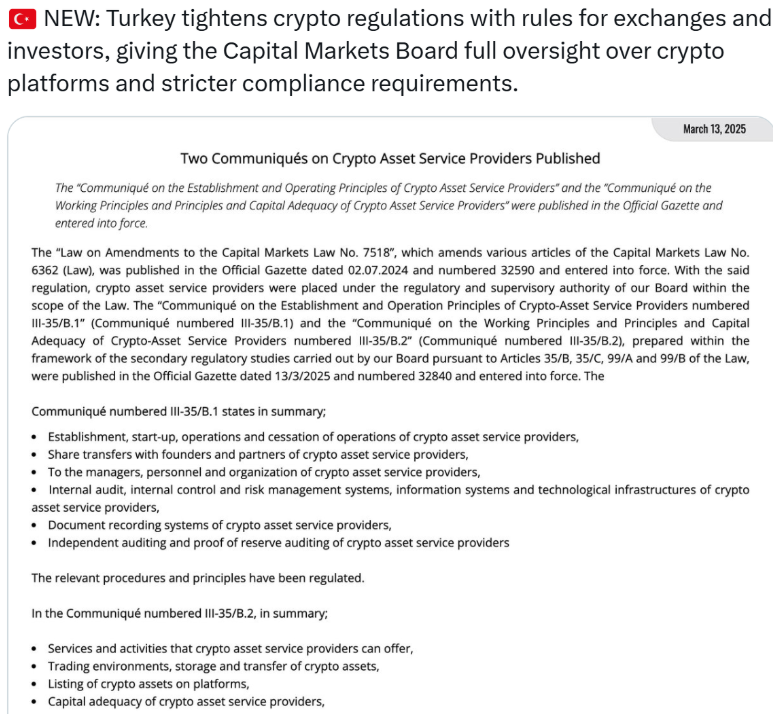

In March, Turkey’s Capital Markets Board (CMB) introduced licensing and operational guidelines for crypto service providers (CASPs), including:

- Minimum capital:

- Exchanges: $4.1 million

- Custodians: $13.7 million

- Executive and shareholder requirements

- Full regulatory oversight of crypto exchanges, wallets, and custodians

Enforcement and Penalties

Finance Minister Mehmet Şimşek emphasized that while the rules are designed to combat criminal activity, “legitimate crypto asset activity will still have room to thrive.” Non-compliant platforms face severe penalties, including license revocation.

Conclusion

Turkey is moving swiftly to regulate its crypto market, signaling a shift toward greater transparency and global compliance. These new rules could set a precedent for other emerging markets grappling with the dual need for innovation and investor protection.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.