Key Crypto Tax Reforms Proposed in Amendment

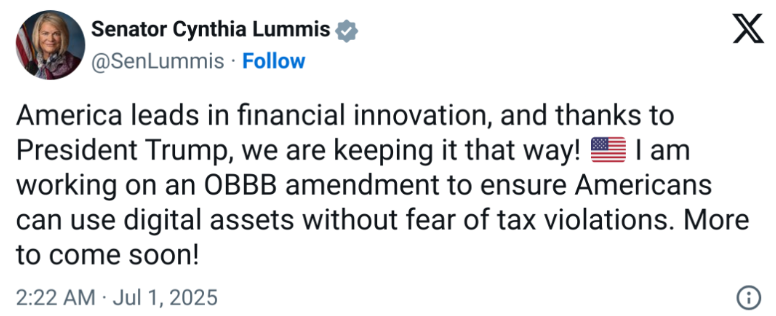

A significant crypto tax measure is being introduced into the U.S. budget bill, aiming to reduce tax burdens on small-scale cryptocurrency transactions and core industry activities. The amendment, led by Senator Cynthia Lummis, seeks to exempt transactions under $300 from taxation while addressing critical issues in staking, mining, and crypto lending.

Tax Relief for Small Crypto Transactions

The proposed amendment includes a de minimis exemption, eliminating taxes on crypto transactions below $300, with an annual cap of $5,000. This change would simplify tax reporting for casual users, removing the need to calculate capital gains on minor transactions. Supporters argue this could encourage broader crypto adoption by reducing compliance hurdles.

Fixing Double Taxation in Staking and Mining

One of the most pressing issues in crypto taxation is the double taxation of staking and mining rewards. Currently, rewards are taxed:

- Upon receipt (as income)

- Upon sale (as capital gains)

The amendment proposes taxing these rewards only at the point of sale, aligning taxation with actual realized income. This change would benefit:

- Stakers (who earn rewards for securing blockchain networks)

- Miners (who receive newly minted coins)

- Airdrop and fork recipients

Closing the Crypto Wash Sale Loophole

Another key provision targets wash trading, a strategy where investors sell assets at a loss and immediately repurchase them to claim tax deductions. Unlike traditional securities, crypto currently allows this practice. The amendment seeks to close this loophole, ensuring fairer tax treatment.

Political Challenges and Budget Impact

The amendment is part of a broader Senate budget negotiation, facing opposition due to concerns over Medicaid cuts and increased deficit spending. Analysts estimate the bill could add over $3 trillion to the national deficit.

Next Steps for the Legislation

- The Senate must vote on the amendment in the ongoing “vote-a-rama” process.

- If approved, the House of Representatives will need to re-pass the revised bill.

- Industry advocates are urging public support to push the amendment forward.

Why This Matters for Crypto Users

If passed, these changes could:

Reduce tax complexity for small crypto transactions

Eliminate double taxation on staking and mining

Prevent tax avoidance through wash sales

The proposal marks a major step toward clearer, fairer crypto tax policies in the U.S. Stakeholders are closely watching as the Senate debates the bill’s future.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.