IBIT and FBTC lead withdrawals as volatility squeezes basis trades and traders eye key inflation data

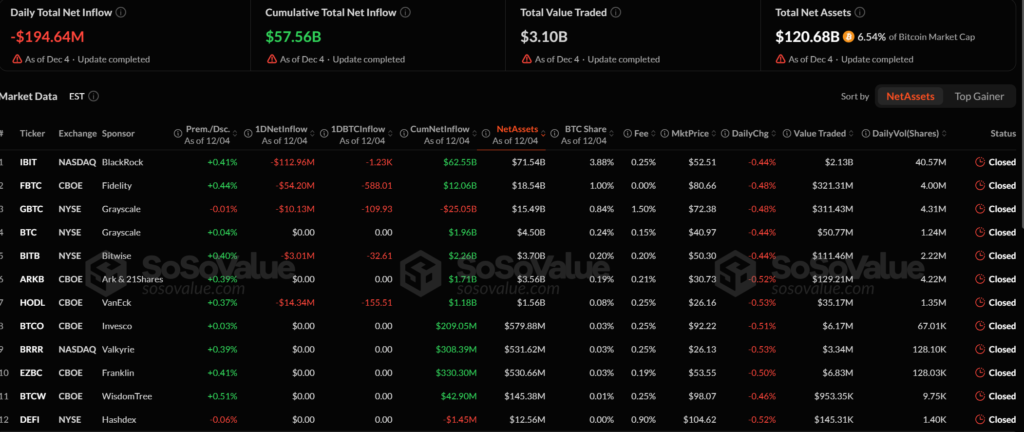

Spot bitcoin exchange traded funds in the United States recorded a sharp reversal in flows on Thursday, registering $194.6 million in net outflows—their largest single-day withdrawal since Nov. 20. The move highlights growing caution across crypto markets amid tightening spreads and macro-driven volatility.

Largest Outflow Since Late November

The latest data shows the downturn was led by BlackRock’s IBIT, which saw $112.9 million in redemptions, followed by $54.2 million from Fidelity’s FBTC. Additional outflows were reported from products including VanEck’s HODL, Grayscale’s GBTC and Bitwise’s BITB.

The spike in withdrawals came just a day after a modest $14.9 million outflow and coincided with weakening ETF activity: trading volume slid to $3.1 billion, down from $4.2 billion on Wednesday and $5.3 billion on Tuesday.

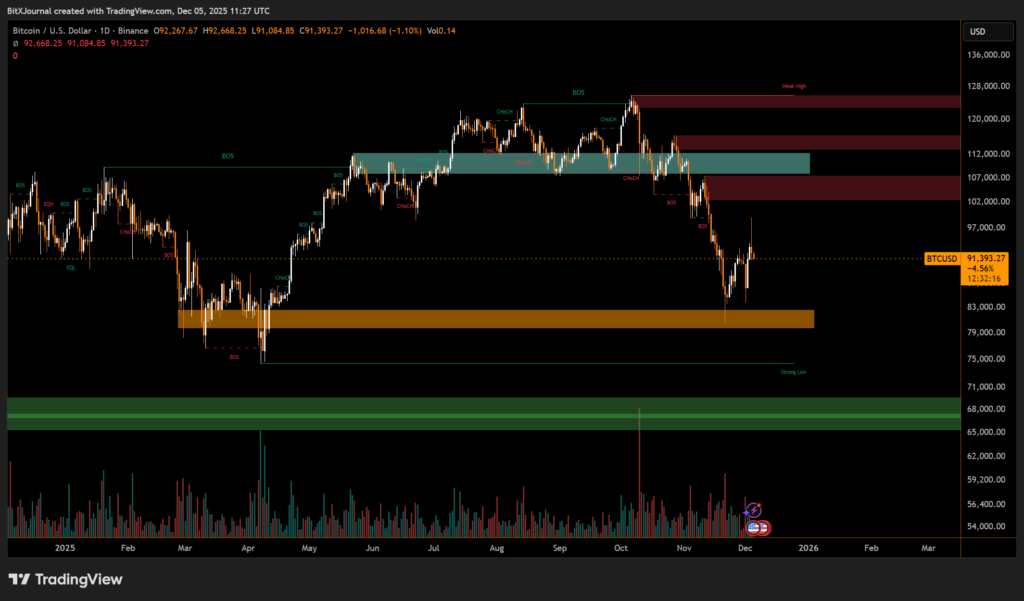

Bitcoin itself drifted lower, slipping 1.4% to $91,989, after briefly touching $84,000 earlier in the week before stabilizing.

Market Volatility Pressures Basis Traders

Analysts attributed the shift largely to unwinds of basis trades, as the spread between futures and spot compressed below breakeven. This dynamic has forced arbitrage desks to sell spot holdings, adding pressure during a period of heightened volatility.

Traders are also preparing for upcoming U.S. inflation data and the Federal Reserve’s Dec. 10 rate decision. Expectations of a 25-basis-point cut could help steady sentiment if it signals a broader easing cycle.

Supply on Exchanges Holds Near Multi-Year Lows

On-chain metrics continue to show structural tightening. Exchaange balances have fallen to roughly 1.8 million BTC, the lowest level since 2017. Analysts describe the market as showing quiet strength, with persistent accumulation, thinning supply and prices holding above the True Market Mean. The key missing catalyst, they note, is a decisive breakout into the $96K–$106K zone.

Spot Ethereum ETFs mirrored bitcoin’s retreat, posting $41.6 million in net outflows after seeing inflows of $140.2 million the previous day. Grayscale’s ETHE recorded the largest withdrawal with $30.9 million.

The combination of elevated volatility, tightening liquidity and macro uncertainty has positioned both bitcoin and ether ETF flows at a sensitive juncture as markets approach the final weeks of 2025.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.