Ukraine is reportedly in the final stages of drafting a bill that would create a strategic Bitcoin reserve, marking a significant step forward in the country’s adoption of digital assets as part of its national financial policy. According to sources close to the matter, the legislation could be introduced to parliament soon, underscoring Ukraine’s progressive stance on integrating cryptocurrency into its state economic strategy.

A Bold Move in Turbulent Times

Since the onset of the Russia-Ukraine conflict, Ukraine has leaned heavily on digital innovation to sustain its economy and defense operations. In 2022, the country became one of the first to receive large-scale crypto donations in Bitcoin and other tokens to fund military and humanitarian efforts. These events laid the groundwork for deeper crypto integration.

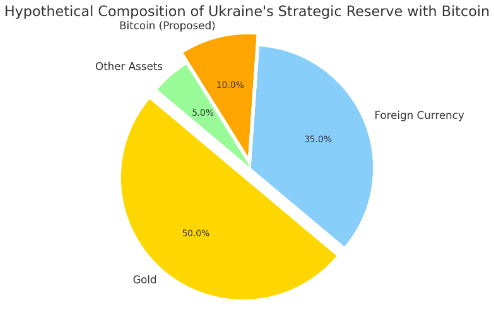

Now, with the strategic reserve proposal, Ukraine aims to institutionalize Bitcoin as part of its state financial infrastructure, putting it on par with gold and foreign currency reserves. The goal is to create a state-managed digital asset treasury that enhances economic resilience and leverages the long-term growth of blockchain-based assets.

Details of the Draft Bill

While the full contents of the bill have not yet been publicly disclosed, reports suggest the legislation would:

- Define the legal framework for holding Bitcoin as a national strategic asset.

- Delegate custodianship to Ukraine’s National Bank and Ministry of Digital Transformation.

- Include provisions for acquiring, securing, and reporting on the crypto holdings.

- Establish clear rules for transparency, auditing, and risk management.

The move could also pave the way for Ukraine to participate in global crypto finance more actively, including receiving aid in digital currencies and potentially issuing sovereign crypto bonds in the future.

Ukraine’s Progressive Crypto Track Record

Ukraine has been a pioneer in crypto policy in the region. The country legalized crypto use for individuals and businesses in 2022 and has collaborated with several blockchain companies to create a regulatory framework. The Ministry of Digital Transformation has worked with global partners, including the Binance exchange and the Stellar Development Foundation, to build blockchain infrastructure for public services and payment rails.

The strategic reserve bill, if passed, will likely cement Ukraine’s reputation as a leader in government-level crypto adoption.

Conclusion

Ukraine’s near-finalization of a strategic Bitcoin reserve bill signals more than just crypto enthusiasm — it’s a calculated step toward embedding digital assets into national policy. As the country rebuilds and redefines its post-war identity, Bitcoin could play a central role not only in financial resilience but also in asserting independence from legacy financial systems.