New onchain auction model on Uniswap v4 aims to boost liquidity, transparency, and fairness in early token markets

Uniswap has launched Continuous Clearing Auctions (CCA), a permissionless token-auction protocol built for Uniswap v4, designed to address liquidity inefficiencies and improve price discovery in decentralized finance (DeFi). The system allows projects to distribute tokens gradually while creating transparent, fair, and stable market conditions.

Addressing Opaque Token Launches

Uniswap highlighted that today’s early-stage token markets are often fragmented and opaque, with pricing influenced by closed-door deals, access restrictions, and thin liquidity. CCA seeks to resolve these issues by ensuring that bidding, pricing, and settlement occur entirely onchain.

“Liquidity formation often happens behind closed doors. CCA offers a more open alternative, allowing tokens to be allocated transparently while ensuring gradual price discovery,” Uniswap stated.

The model distributes tokens block by block, allowing participants to submit maximum bids and receive allocations only when the clearing price falls below their limit. This reduces sniping and encourages early participation, promoting a market-clearing price that better reflects demand.

How Continuous Clearing Auctions Work

Projects can set auction parameters including token quantity, starting price, duration, and optional modules such as ZK Passport verification for private yet verifiable participation. Bidders place orders throughout the auction, with each block settling at a single market-clearing price. Allocations are pro rata if demand exceeds supply for a block.

When the auction concludes, all proceeds automatically seed a Uniswap v4 liquidity pool at the final price, providing immediate secondary market liquidity.

“By combining transparency, fairness, and immediate liquidity, CCA improves both early-stage token distribution and long-term market stability,” noted a DeFi analyst.

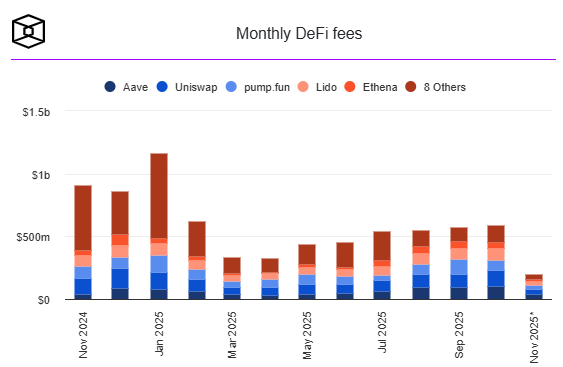

CCA is part of Uniswap’s broader push to enhance liquidity tools on v4, alongside initiatives like fee switches and sustainability-focused token models. The launch comes amid a rebound in DeFi activity, with Uniswap and Aave leading growth in protocol fees and onchain engagement.

By enabling fairer, more transparent auctions, Uniswap’s CCA model could set a new standard for token launches and liquidity formation in DeFi.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.