Strong rebound meets resistance near $10 as traders eye crucial support zones

The decentralized exchange token Uniswap (UNI) experienced a sharp rally on November 11, climbing nearly 13% intraday before losing momentum and retracing to around $8.98 at press time. The move came after a strong rebound from the $5.40 zone, signaling renewed investor interest in decentralized finance (DeFi) assets.

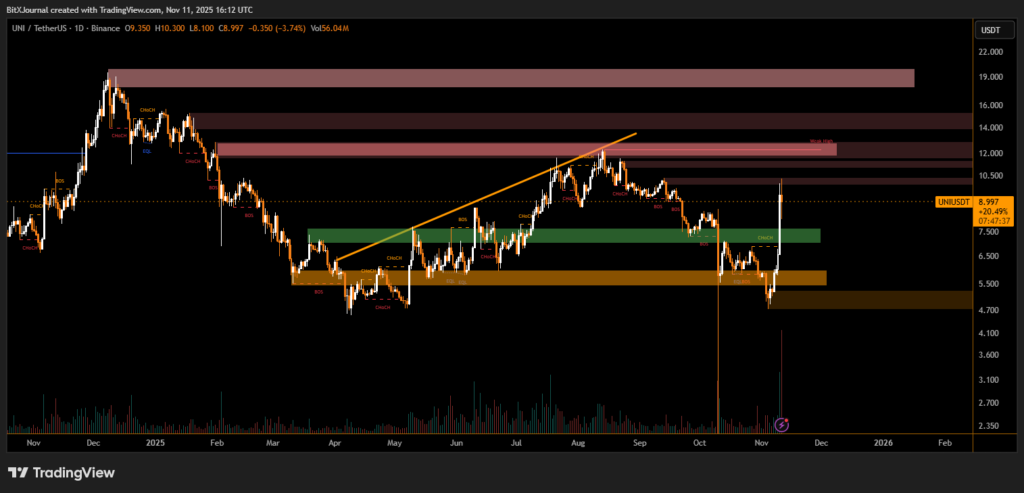

Analysts note that UNI’s price action is displaying classic signs of a technical breakout followed by a short-term correction. The daily chart indicates that UNI tested a significant resistance region near $10.30, aligning with a previous liquidity zone observed in early September. The token’s current retracement reflects traders taking profits after the rapid upside surge.

“The $9 to $10 zone is a key battle area for UNI bulls and bears. A sustained close above $10 could open the door to higher levels around $12.50 and $14.00, but failure to hold current gains might lead to a retest of the $7.20–$7.50 support region,” said BitXJournal market strategist.

The volume spike accompanying the rally suggests that institutional and whale activity played a role in driving the short-term momentum. The price action also shows a Change of Character (ChoCH) on the daily timeframe, often a precursor to trend continuation when supported by higher volume.

Traders are closely monitoring the Break of Structure (BOS) levels highlighted on the chart. A confirmed BOS above the $10.50 resistance could validate a bullish continuation toward the $12–$13 range. However, if selling pressure intensifies, the $6.50 to $5.50 area — identified as a strong demand zone — may serve as a cushion for further downside.

In the broader market context, UNI’s recent move reflects improving sentiment across DeFi tokens as liquidity and volume gradually recover. Maintaining stability above $8.50 will be crucial for bulls to regain control and sustain the upward trajectory.

BitXJournal Market observers emphasize patience, noting that retracements after strong breakouts often set the stage for the next leg higher if structural support holds firm.

UNI’s near-term direction now depends on whether bulls can reclaim momentum above $10 or if bears seize control for a deeper pullback.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.