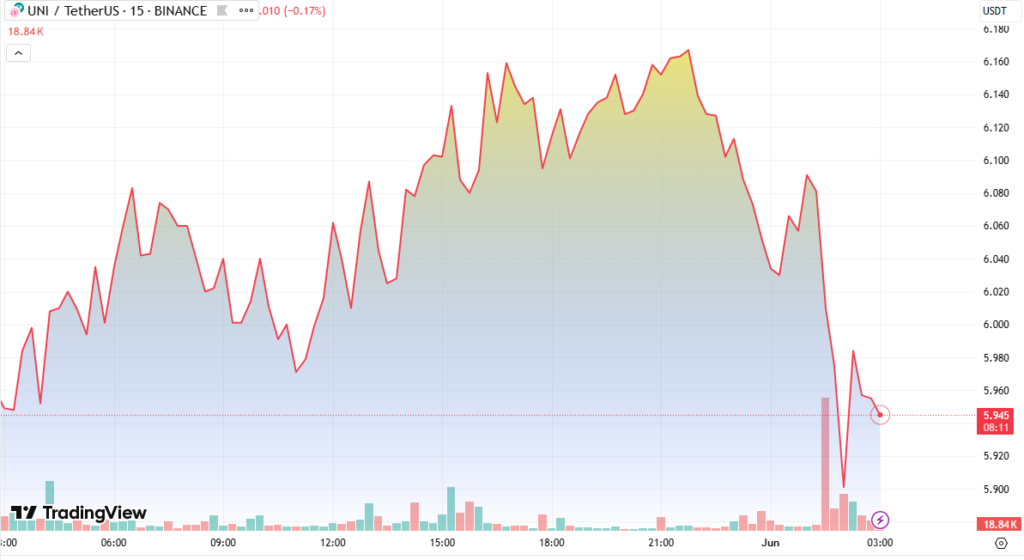

Uniswap’s native token (UNI) experienced a sharp 10.9% intraday swing, driven by escalating U.S.-China trade tensions and heightened institutional repositioning. The volatile session highlights how macroeconomic uncertainty continues to weigh heavily on crypto market sentiment.

Key Highlights

- Volatility Surge: UNI traded within a $0.644 range (from $5.945 to $6.589), marking an intraday move of 10.9%.

- Breakout Level: UNI rebounded above the critical $6.50 resistance, now eyeing the $7.50 target.

- Volume Spike: Heavy volume at the $5.954 low (~4.4M) created a strong demand zone.

- Institutional Uncertainty: Large wallets and funds show mixed signals as geopolitical concerns loom.

📉 Technical Analysis Snapshot

- Selloff & Reversal: UNI plunged from $6.510 to $5.954 between 16:00–01:00, before recovering on high volume.

- Consolidation Zone: Price stabilized between $6.000–$6.050, reflecting short-term market indecision.

- Bullish Pattern Forming: A recovery rally at 14:01 showed a 3.6% uptick from $6.032 to $6.254, on increasing volume (28.7K), forming a bullish price channel.

- Support/Resistance Zones:

- Support: $6.030

- Resistance: $6.055

- Current Close: $6.051

Macro Context: Trade Tensions Driving Risk Sentiment

The intensifying U.S.-China trade conflict is having ripple effects across risk assets, with crypto tokens like UNI exhibiting heightened sensitivity to global headlines. Institutional investors are reassessing digital asset allocations, leading to increased volatility, especially in DeFi-linked assets.

Investor Takeaway

- Short-Term: Watch for consolidation above $6.05 as a potential base for the next leg toward $6.50 and beyond.

- Medium-Term: A confirmed break above $6.50 with volume could target $7.00–$7.50, provided macro sentiment doesn’t deteriorate further.

- Risk Warning: Continued geopolitical instability could trigger additional corrections across the crypto sector.