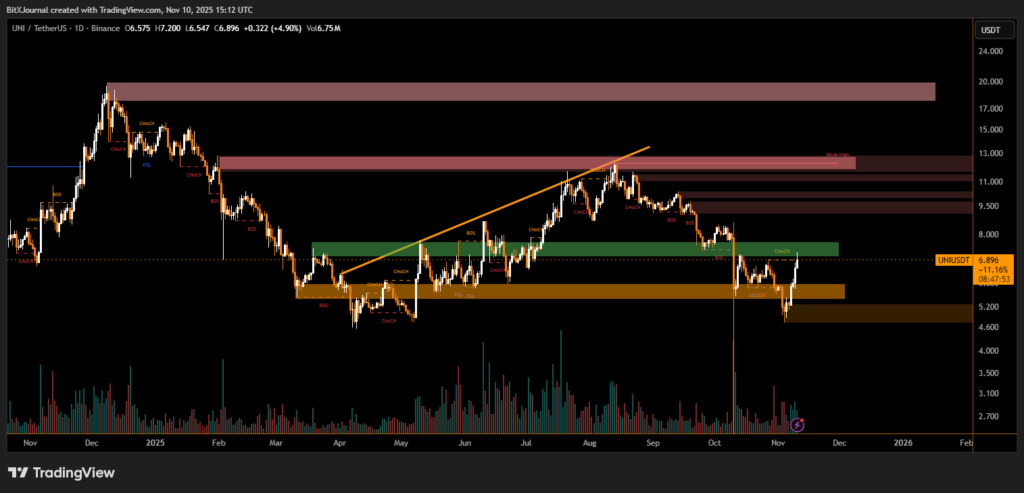

Uniswap’s price bounces sharply from a major demand zone, breaking short-term resistance as traders eye the $7.20 mark.

Uniswap (UNI) recorded an impressive rebound on Monday, surging over 15% to trade near $6.83 after a week of subdued price action. The decentralized exchange token rallied as bullish momentum returned to the altcoin market, pushing UNI above its recent consolidation zone. The move highlights renewed investor confidence as the broader market recovers from early-November weakness.

On the daily chart, UNI has bounced strongly from the $5.00–$5.30 demand area, an accumulation zone that previously acted as a support floor in late April. This rebound coincides with increased trading volume, suggesting renewed accumulation by market participants.

Technically, the breakout aligns with a clear “break of structure” (BOS) formation, signaling a potential trend reversal from bearish to bullish. The token has now entered a short-term resistance zone between $6.80 and $7.20, which analysts describe as a key test area for continuation.

“A sustained close above $7.00 would confirm a structural shift in UNI’s market behavior,” BitXJournal market analyst commented. “The technical setup suggests upside potential toward $8.20 if buying pressure persists over the next sessions.”

The next significant resistance sits around $8.00–$8.50, while immediate support lies near $6.20, where previous lower highs were formed. A retest of this zone could act as a base for a continued uptrend if bulls maintain control.

BitXJournal Experts also note that Uniswap’s on-chain data remains supportive. Transaction volumes and liquidity pool activity have stabilized, hinting at improving network health. “The price action shows strong demand returning at lower levels, which typically precedes multi-week rallies in DeFi tokens,” another strategist noted.

With Uniswap’s 15% surge and breakout above local resistance, technical indicators point toward a short-term bullish recovery. The next few sessions will determine whether UNI can sustain above $7.00 — a critical level that could open the door for a broader move toward $8 and beyond.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.