Uniswap’s native token, UNI, surged over 5% to break past key resistance at $6.37, defying global macroeconomic concerns, including renewed tariff tensions. The rally was driven by a spike in buying volume, as investors rotated into altcoins despite broader market uncertainty.

UNI Defies Geopolitical Pressure With Bullish Price Action

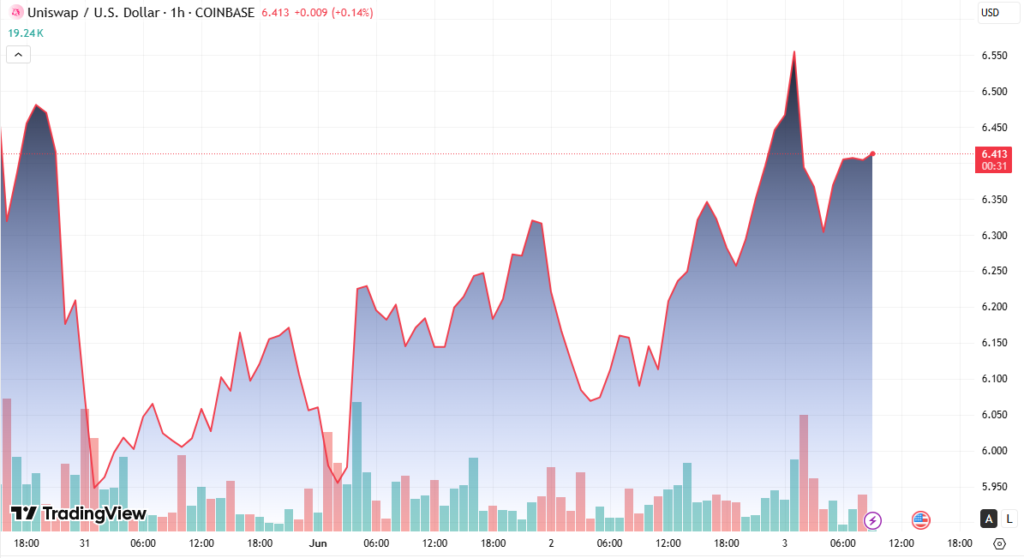

In the past 24 hours, UNI climbed from $6.09 to a session high of $6.5557, representing a 5.09% gain. The price move came amid ongoing speculation over U.S.-China trade tensions and potential interest rate cuts in the U.S. and Europe.

UNI’s performance signals growing investor interest in alternative assets, even in the face of global risk events.

The bullish breakout occurred despite an initial pullback, with strong support forming near $6.30, a critical level now seen as a base for further upside.

Volume Spikes Reinforce Buyer Confidence

Heavy volume accompanied the rally, peaking at 3.89 million during the early surge. A sharp rejection at $6.5557 created a short-term resistance zone, but buyers quickly stepped back in, validating a bullish outlook.

Aggressive buying at support zones confirmed strong market conviction, allowing UNI to stabilize above the $6.30–$6.33 range.

At 07:59, trading volume spiked to 56,320, suggesting renewed momentum and confirmation of a support zone around $6.38–$6.39. Price retested resistance at $6.41 multiple times, indicating a potential breakout with sustained buying.

Short-Term Outlook: Consolidation and Potential Upside

Despite volatility, UNI maintained higher lows and showed consistent attempts to break key resistance, signaling possible bullish continuation. The 0.49-point price range, or 8.07% swing, highlights elevated short-term volatility.

Support at $6.30–$6.33 and resistance at $6.41 form a clear price structure that may guide near-term moves.

If UNI consolidates above $6.40, technical indicators suggest a path toward retesting recent highs or even pushing toward the $6.60 mark, assuming macro conditions remain favorable.

Conclusion

Uniswap’s UNI token is displaying strong bullish behavior, shrugging off broader market fears to regain upward momentum. With solid volume, rising demand, and defended support levels, UNI could be poised for further gains — provided consolidation continues above key price thresholds.

Altcoin strength amid macroeconomic tension highlights investor appetite for decentralized finance assets like UNI.