US Bankers Urge Delay on Crypto Firms’ Charter Decisions

Major U.S. banking and credit union groups are calling on federal regulators to delay decisions on bank license applications submitted by crypto companies. In a formal request to the Office of the Comptroller of the Currency (OCC), these groups argue that granting national bank charters to crypto firms such as Circle and Ripple Labs would mark a significant shift in policy.

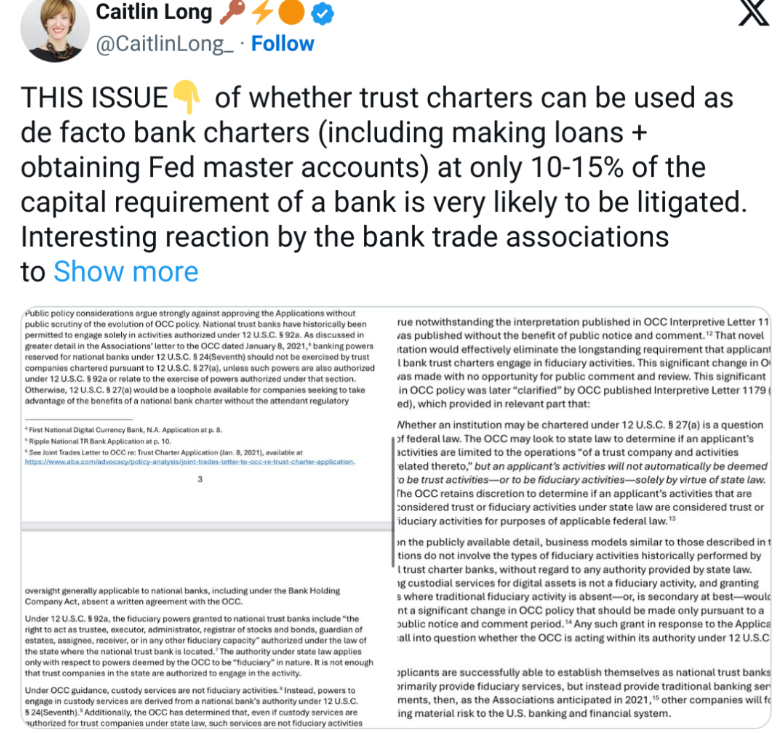

“There are legal and policy questions regarding whether the applicants’ plans fall under fiduciary activities historically performed by trust banks,” stated the letter. The pushback centers on the concern that crypto business models differ sharply from traditional banking structures.

Crypto Companies Aim for Federal Banking Status

Crypto firms including Circle, Ripple, and Fidelity Digital Assets have recently applied for national trust bank charters. If approved, this would allow them to operate federally, eliminating the need for multiple state-level licenses, and offering services such as payment settlement and digital asset custody.

Obtaining a federal charter would enable these firms to function as banks, without the capital or regulatory obligations that conventional banks face.

However, banking groups argue that the public disclosures of the applications are insufficient, and that the OCC must allow for broader public comment before any decision is made.

Concerns Over Stability and Competitive Fairness

One of the core objections is that providing custody of digital assets is not a fiduciary activity by definition. Therefore, granting trust bank charters for such functions would represent a break from decades of precedent.

The banking groups warn that approving such charters could create systemic risks, potentially allowing a wave of nontraditional firms to offer banking services with lighter oversight.

They argue this could allow entities to enter banking with a fraction of the capital requirements traditional banks must meet — potentially creating competitive imbalances and regulatory arbitrage.

Legal Action Could Follow If OCC Proceeds

Industry watchers believe the issue could escalate into litigation. Custodia Bank founder Caitlin Long highlighted the tension, noting that if crypto firms are approved for these charters, traditional banks may be incentivized to convert into trust companies, operating under lighter regulation.

“This could open a back door into full-service banking without full regulation,” Long warned.

Stablecoin Laws Drive Demand for Bank Licenses

Legal experts believe the newly passed GENIUS Act, which introduces a federal stablecoin framework, is pushing stablecoin issuers to seek bank charters.

Although the new license allows stablecoin issuance, it limits broader activity and still requires state-by-state compliance. A national trust bank charter would eliminate these hurdles, enabling crypto firms to operate nationwide and expand services.

Final Thoughts

The ongoing clash between traditional finance and crypto firms over federal banking access highlights growing tensions as digital assets push deeper into regulated spaces.

Whether the OCC proceeds or delays, the outcome of this challenge could reshape the structure of both traditional and digital banking in the United States.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.