A United States federal judge has lifted a freeze on $57.6 million in USDC stablecoins connected to the infamous Libra token scandal, one of the biggest rug pulls in crypto history. This decision provides memecoin promoter Hayden Davis and former Meteora DEX CEO Ben Chow renewed access to the funds, following months of legal disputes.

Why Were the Funds Frozen?

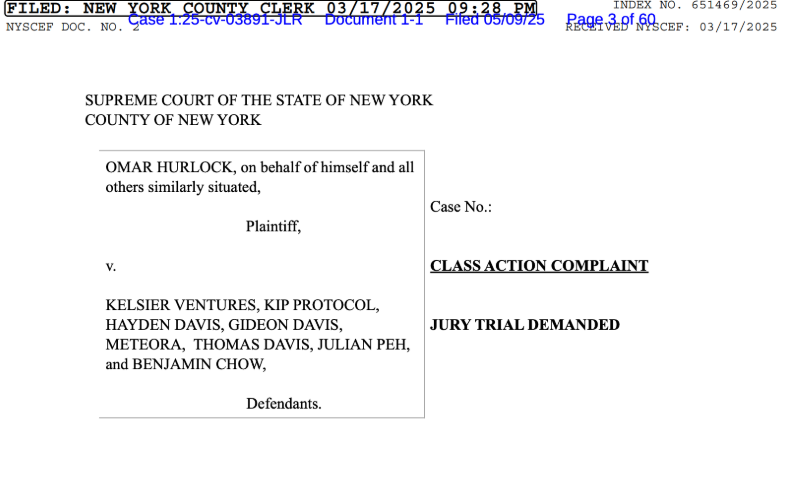

The freeze was originally imposed in May 2025 by Judge Jennifer L. Rochon during a class-action lawsuit targeting Davis, Chow, and others, including blockchain firm KIP Protocol and its co-founder, Julian Peh. The case accused the defendants of orchestrating a massive rug pull under the guise of the Libra token project, which collapsed shortly after launch.

Despite the lawsuit, the judge cited ongoing cooperation from the defendants and the availability of funds to reimburse victims as reasons to lift the freeze. Rochon noted that the defendants had made no attempt to move the frozen assets, reducing concerns about potential misuse.

The Libra Token Scandal: What Happened?

Launched in February 2025, Libra token positioned itself as a project to support Argentina’s small businesses and quickly gained traction after being promoted by Argentine President Javier Milei on social media. The hype drove millions into the project, but the token collapsed within hours, wiping out an estimated $107 million in investor funds.

The fallout sparked:

- Class-action lawsuits against project founders and promoters

- An ethics investigation into President Milei for endorsing the token

- Allegations of political cover-up after the investigation was abruptly closed

Milei later denied any formal connection to Libra, stating his endorsement was just a generic post supporting private ventures.

Although Davis attempted to dismiss the lawsuit in July, his motion was rejected. However, Judge Rochon expressed doubts about the lawsuit’s success, suggesting the case may struggle to prove liability. For now, the USDC funds remain accessible to defendants, but investors continue to pursue legal remedies.

What Does This Mean for Crypto Investors?

The Libra token collapse underscores two critical lessons for investors:

- Always verify project fundamentals before investing, regardless of celebrity or political endorsements.

- Regulatory gaps in the crypto space make due diligence essential to avoid falling victim to scams and rug pulls.

As the industry matures, regulators are increasingly focused on protecting investors and enforcing compliance — but trust and transparency remain the best defense.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.